THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

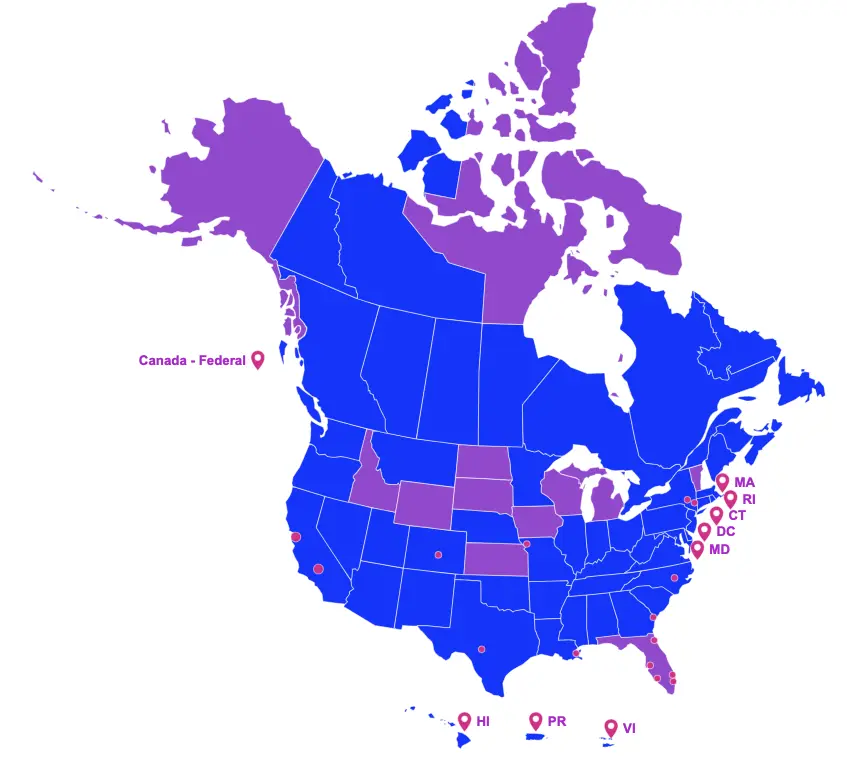

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ON THE GOVERNOR'S DESK

Awaiting Signature

Rhode Island (H 7247) and (S 2326)

House Bill 7247 and Senate Bill 2326 propose to amend the Rhode Island motion picture production tax credit program as follows:

Authorizes motion picture tax credits for a production that does not have its primary location (at least 51% of total principal photography days) within the state, provided a minimum of ten million dollars ($10,000,000) in state certified production costs are incurred and paid within a twelve (12) month period.

This Act would take effect upon passage.

Virginia (S 923)

Senate Bill 923 proposes to amend the Virginia motion picture production tax credit program as follows:

- Extends the sunset date to December 31, 2026, previously December 31, 2021.

PROPOSED LEGISLATION

Still in the House or Senate

Georgia (H 1037)

House Bill 1037 proposes to amend the Georgia Entertainment Industry Investment Act as follows:

- For projects “initially” certified by the Georgia Department of Economic Development (GDEcD) on or after January 1, 2021:

- Requires a production company to submit an application for a “final” certification within one year from the date it completes a state certified production;

- Stipulates the tax credit shall be considered earned in the taxable year in which it is issued a final certification;

- Reduces the number of years the credit may be carried forward from five years to three years;

- Delays the issuance of the additional 10% promotional credit until the qualifying project is commercially distributed in multiple markets; and,

- Requires an audit be performed by the Georgia Department of Revenue (GA DOR) or an independent third-party auditor certified by the GA DOR (subject to additional adjustments by GA DOR) under the following conditions:

- The project was initially certified by the GDEcD on or after January 1, 2021, but before December 31, 2021 and the project’s total estimated tax credit amount exceeds $2.5 million; or,

- The project was initially certified by the GDEcD on or after January 1, 2022, but before December 31, 2022 and the project’s total estimated tax credit amount exceeds $1.25 million; or,

- For any project initially certified by the GDEcD on or after January 1, 2023.

Illinois (H 5026) and (S 3359)

House Bill 5026 and Senate Bill 3359 propose to amend the Illinois Film Production Services tax credit as follows:

- Requires a payment to the Illinois Workforce Training and Diversity Fund equal to 1.5% of the credit amount when the credit is transferred to an Illinois taxpayer.

Illinois (H 5101)

House Bill 5101 proposes to amend the Illinois Film Production Services tax credit for accredited productions commencing on or after July 1, 2020, as follows:

- Creates the following additional credits:

-

- 5% of the labor expenditures generated by the employment of Illinois residents who reside outside the metropolitan area, defined as, the City of Chicago and any part of the state located within 30 miles of the city; and,

- 5% on all qualifying expenditures (labor, spend, high poverty area, and residents from outside the metropolitan area), if 50% or more of the total hours of principal photography filming or taping are completed in the state but outside the metropolitan area;

- Modifies the definition of Illinois production spending and labor expenditure as follows:

- 1st $1 million of compensation per employee, for up to four contractual or salaried employees, resident or nonresident;

- 1st $100,000 of compensation of each contractual or salaried resident (not including the four contractual or salaried employees above);

- 100% of wages paid to each employee that is an Illinois resident;

- 1st $200,000 of wages paid to each nonresident;

- Expands the definition of accredited productions to include:

- Talk shows intended for national audience

- Reality competition; and,

- Eliminates the sunset date, previously December 31, 2026.

New York (A 9509) and (S 7509)

Assembly Bill 9509 and Senate Bill 7509 propose to amend the Empire State Film Production and Postproduction tax credit programs for applications received on or after April 1, 2020, as follows:

- Reduces the film production credit to 25% of qualified expenses, previously 30%;

- Reduces the credit on qualified postproduction costs incurred at a qualified postproduction facility located within the state, but outside the metropolitan commuter transportation district (MCTD), to 30%, previously 35%;

- Reduces the postproduction only credit to 25% of qualified postproduction costs incurred at a qualified postproduction facility within the MCTD, previously 30%;

- Implements a minimum spend requirement, except for pilots, in the amount of:

- $1 million for projects with a majority of principal photography shooting days that take place within Westchester, Rockland, Nassau, or Suffolk counties or any of the five boroughs of New York City;

- $250,000 for projects shooting the majority of principal photography days in any other New York county;

- Excludes variety shows, except those that are relocated television productions, from the definition of a qualified project; and,

- Extends the sunset date to December 31, 2025, previously December 31, 2024.

New York (A 9760) and (S 7160)

Assembly Bill 9760 and Senate Bill 7160 propose to amend the Empire State Television Writers’ and Directors’ Fees and Salaries credit as follows:

- Disallows any salaries or fees related to a non-credited writer from qualifying for the Empire State Film Production tax credit, previously qualified up to $75,000 per series of episodes.