THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

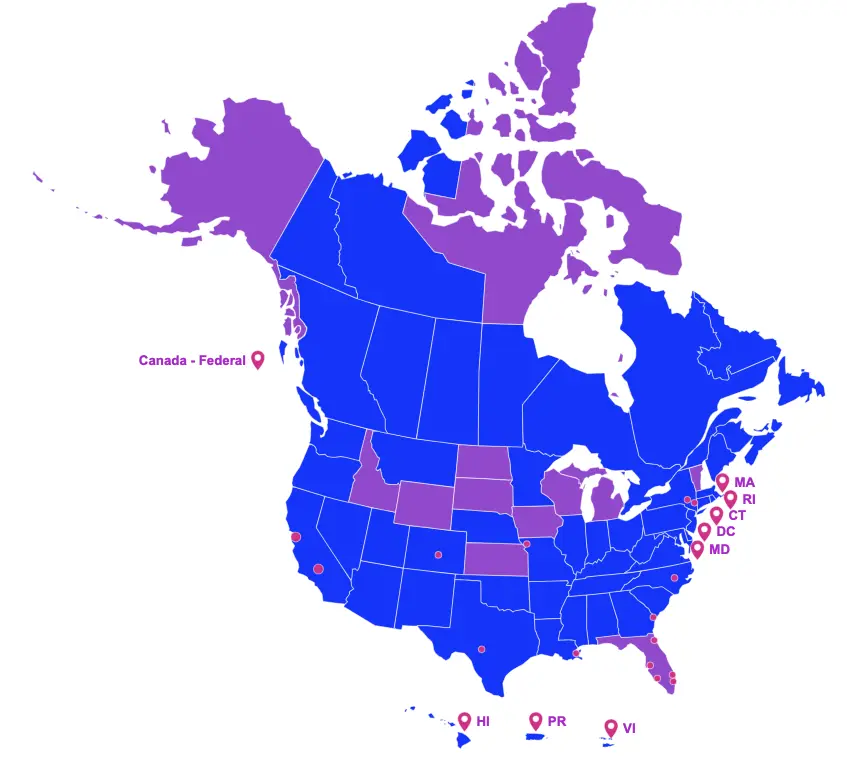

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

Arizona

On July 6, 2022, House Bill 2156 became law without Governor Doug Ducey’s signature, creating the Arizona Motion Picture Production incentives program. Details of the program are as follows:

- Creates a refundable tax credit on the total amount of qualified production costs that is equal to:

- 15 percent for a motion picture production company that spends up to $10 million;

- 17.5 percent for a motion picture production company that spends more than $10 million but less than $35 million;

- 20 percent for a motion picture production company that spends more than $35 million;

- Allows for additional bumps, as follows:

- 2.5 percent on below-the-line resident labor costs;

- 2.5 percent of the total amount of qualified production costs if:

- The production company uses a qualified production facility in the state to produce the motion picture production; or,

- The production company films primarily at a practical location, produces and films the project primarily in Arizona and performs ALL preproduction, postproduction and editing at an in-state qualified production facility;

- 2.5 percent of the total amount of qualified production costs if the production is produced and filmed in association with a “long-term tenant”, as defined, of a qualified production facility;

- Establishes the following amount of tax credits that may be preapproved in each calendar year:

- 2023, $75 million;

- 2024, $100 million;

- 2025 and thereafter, $125 million;

- Limits the amount of tax credits that may be awarded to projects that qualify for the program by filming primarily at a practical location in Arizona, produce and film the motion picture production primarily in Arizona and perform ALL preproduction, postproduction and editing at an industry standard facility in Arizona, if such a facility is available, to $25 million in each calendar year;

- Qualifies resident and nonresident above-the-line and below-the-line labor costs;

- Requirements:

- To qualify for the program a motion picture must do either of the following:

- Use a qualified in-state production facility to produce the motion picture production; or

- If the motion picture is filmed primarily at a practical location, produce and film the motion picture production primarily in Arizona and perform ALL preproduction, postproduction and editing at an industry standard facility in Arizona, if such a facility is available;

- Maintain the production company’s production labor positions in Arizona;

- Include in the credits an acknowledgment that the production was filmed in Arizona;

- Provide an audited statement completed by an in-state certified public accountant; and,

- To qualify for the program a motion picture must do either of the following:

- Establishes a sunset date of December 31, 2043.

Delaware

On June 30, 2022, Governor John Carney signed Senate Bill 252, creating the Delaware Motion Picture and Television pilot program as follows:

- Establishes a rebate of up to 30 percent of production, preproduction, or postproduction expenditures incurred in the State that are directly used in a production activity of digital entertainment activity; and,

- Provides for a program funding cap of $1 million for the 2023 fiscal year (July 1 – June 30).

Hawaii

On June 27, 2020, Governor David Ige signed House Bill 1982 amending the motion picture, digital media, and film production income tax credit as follows:

- Increases the tax credit that may be earned on qualified production costs as follows:

- From 20 percent to 22 percent of qualified production costs incurred by a qualified production in any county of the state with a population of over 700,000;

- From 25 percent to 27 percent of qualified production costs incurred by a qualified production in any county of the state with a population of 700,000 or less;

- Requires every person making a payment to a loan-out company and claiming a tax credit to deduct and withhold an amount equal to the highest rate of tax plus any applicable county surcharge for all payments made to the loan-out company for services performed in the state;

- The amounts withheld under this section shall be deemed to be a general excise tax withholding for the benefit of the loan-out company performing the service;

- Increases the total tax credits that may be claimed by each production from $15 million to $17 million;

- Reduces the minimum amount of required qualified production expenditures from $200,000 to $100,000;

- Eliminates the requirement for productions to submit a verification review by a qualified certified public accountant when applying for the film production tax credit;

- Requires the state to issue the tax credit certificate to the taxpayer no later than seven months after receipt of the taxpayer’s statement;

- Requires each taxpayer claiming the motion picture, digital media, and film production income tax credit to submit a fee in an amount equal to 0.2 percent of the tax credit claimed by the qualified production; and,

- Extends the sunset date of the program thru December 31, 2032.

Pennsylvania

On July 8, 2022, Governor Tom Wolf signed House Bill 1342, amending the Pennsylvania Entertainment Production program as follows:

- Increases annual funding cap from $70 million to $100 million per fiscal year (July 1 – June 30);

- Defines “Pennsylvania film producer” as a Pennsylvania domiciled film production company that meets the following:

- The principal tax jurisdiction is this Commonwealth;

- A majority of the taxpayer’s owners are Pennsylvania resident;

- The taxpayer employs fewer than 15 full-time employees; and,

- Establishes the Pennsylvania film producer reserve, allocating $5 million of the tax credits authorized in support of projects produced by a Pennsylvania film producer

This act shall take effect immediately.

Rhode Island

On June 27, 2022, Governor Daniel McKee signed House Bill 7123, modifying the Rhode Island motion picture production company tax credit and musical and theatrical production tax credits programs as follow:

Motion picture production company tax credit

- Increases the annual funding cap from $30 million for calendar year 2022 to $40 million for calendar year 2023 and $40 million for calendar year 2024;

Musical and theatrical production tax credit

- Amends the definition of “Pre-Broadway production” for purposes of musical and theatrical production tax credits to include live stage productions performed in qualified production facilities having a presentation scheduled for Broadway’s theater district in New York City within thirty-six (36) months after its Rhode Island presentation rather than the previous period of twelve (12) months.

Tennessee

On June 1, 2022, Governor Bill Lee signed Senate Bill 2897, appropriating $2.2 million to the Tennessee Film and Television Incentive Fund for the 2023 fiscal year (July 1 – June 30).

Virginia

On June 22, 2022, Governor Glenn Youngkin signed House Bill 30 which appropriates $4.15 million for the 2023 fiscal year and $5.15 million for the 2024 fiscal year (July 1 – June 30) to the Governor’s Motion Picture Opportunity Fund. These funds are to be used at the discretion of the Governor to attract film industry production activity to Virginia.