THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

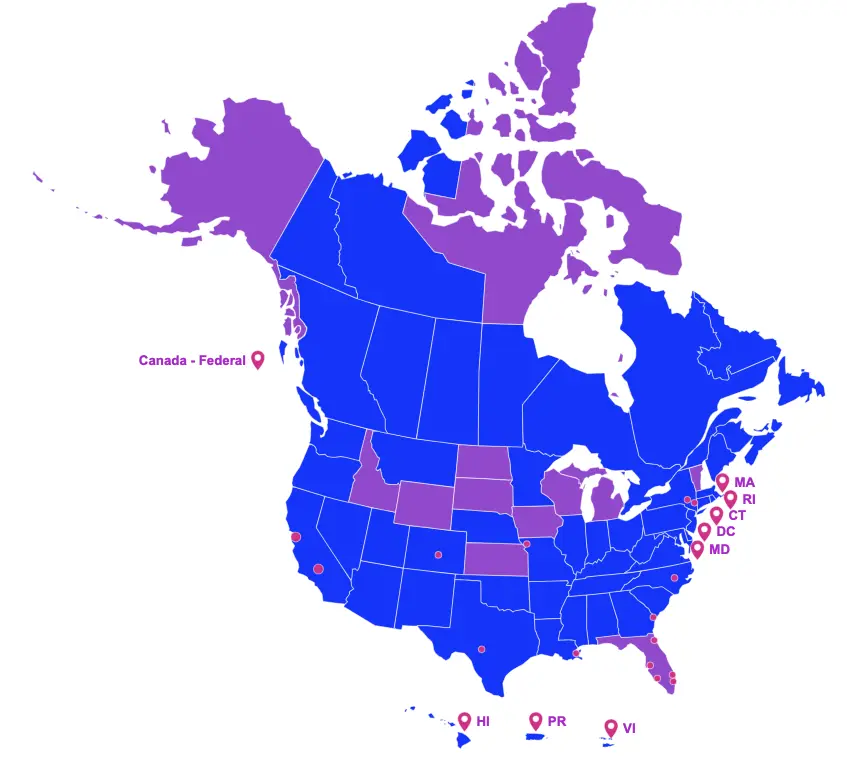

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ON THE GOVERNOR'S DESK

Awaiting Signature

New York (A 6683) and (S 5864-a)

Assembly Bill 6683 and Senate Bill 5864-a propose to amend the Empire State film production credit to allow television writers’ and directors’ fees as eligible costs, subject to the following provisions:

- Allows for a refundable tax credit equal to 30% of qualified television writers’ and directors’ fees and salaries incurred in the production of a qualified television project, provided that:

- The qualifying writer or director is a minority group member, as defined, or a woman;

- Salaries or fees paid to any writer or director who is a profit participant in the qualified film are not eligible;

- Limits the amount of credit that may be earned on qualified television writers’ and directors’ fees to:

- $50,000 for any one specific writer or director for the production of a single television pilot or a single episode of a television series; and,

- $150,000 for the employment of any one specific writer or director;

- Limits the qualifying salaries or fees for a non-credited writer to $75,000 per series of episodes;

- Stipulates the credit shall be allowed for the taxable year in which the production of such qualified film is completed; and,

- Limits the aggregate amount of credits allowed for writers and directors to $5 million per calendar year.

If passed, the Act shall take effect immediately and shall apply to taxable years beginning on or after January 1, 2020.