THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

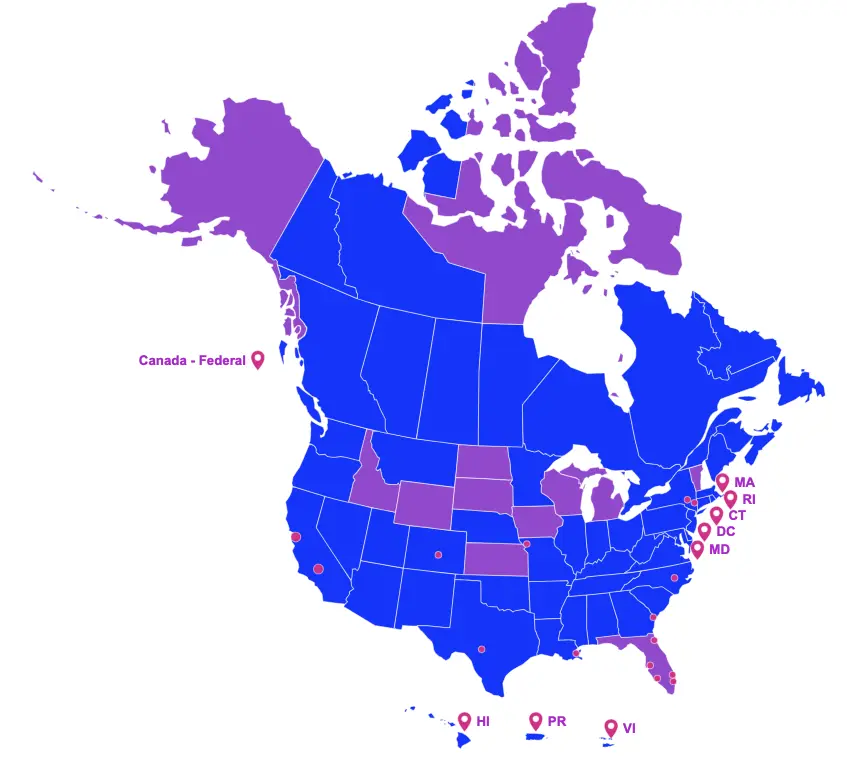

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

Arkansas

On April 10, 2023, Governor Sarah Huckabee Sanders signed House Bill 1592 into law, thereby amending the digital product and motion picture industry development act program as follows:

- Increases the tax incentive percentage from 20% to 25% on all qualified production costs in connection with the production of a state-certified film project;

- Allows for the following additional uplifts, up to a maximum of 30%;

- 5% for either hiring below-the-line employees whose full-time permanent address is located in a Tier 3 or Tier 4 county in the annual ranking of counties established by the Arkansas Economic Development Commission under § 15-4-2704; or

- Expenditures paid to a person or business for qualified production costs with a state-certified production located in a Tier 3 or Tier 4 county in the annual ranking of counties established by the commission under § 15-4-2704;

- 5% for producing a multi-project production, including without limitation a television series and a multi-film project;

- Increases the tax incentive percentage from 20% to 25% on all qualified production costs in connection with the postproduction of an approved state-certified film project;

- Allows for the following additional percentage uplifts, up to a maximum of 30%;

- 5% for either hiring below-the-line employees whose full-time permanent address is located in a Tier 3 or Tier 4 county in the annual ranking of counties established by the Arkansas Economic Development Commission under § 15-4-2704; or

- Expenditures paid to a person or business for qualified production costs with a state-certified production located in a Tier 3 or Tier 4 county in the annual ranking of counties established by the commission under § 15-4-2704; and,

- 5% for producing a multi-project production, including without limitation a television series and a multi-film project.

This act is for tax years beginning on or after January 1, 2023.

Kentucky

On March 23, 2023, Governor Andrew Beshear signed House Bill 303 into law, thereby amending the Kentucky Film and Entertainment Industry Incentive Program as follows:

- Allocates $25 million of the $75 million calendar year funding for “continuous film production” projects, as defined;

- Requires a loan out company to be registered and in good standing with the Kentucky Secretary of State;

- Requires loan out companies to withhold Kentucky state income tax from payments made to its employees for services provided in Kentucky; and,

- Clarifies that a production company must begin filming or production in Kentucky within six months of approval (previously applicated date) and complete production in Kentucky within two years of their production start date.

These changes will apply to any project approved by the board on or after January 1, 2024.

New Mexico

On April 7, 2023, Governor Michelle Lujan Grisham signed House Bill 547, thereby amending the New Mexico Film Production Tax Credit program as follows:

- Increases current annual funding ($110 million) by $10 million per fiscal year (7/1 – 6/30) beginning with fiscal year 2024 through 2028, which ultimately establishes $160 million funding for fiscal year 2028 and beyond;

- Expenditures for resident performing artists are no longer required to be included when calculating the $5 million credit limitation for performing artists;

- Allows up to an additional $10 million in credits for payments made by a New Mexico film partner (NMFP), as defined, for the services of nonresident performing artists, directors, producers, screenwriters, and editors provided the total payments allowed shall not exceed an aggregate maximum of $40 million for all productions in a fiscal year;

- In addition to the base credit of 25%, allows additional uplifts as follows (40% maximum):

- 10% on direct production expenditures and postproduction expenditures for work, services or items provided on location for a production located in New Mexico that is at least sixty miles from the city hall of the county seat of Bernalillo and Santa Fe counties;

- 5% for either of the following:

- On a standalone pilot intended for series in New Mexico or on series television with an order for at least 6 episodes in a season with a minimum per episode New Mexico budget of $50,000 or more or

- For a production in a qualified facility;

- Confirms that the “nonresident below-the-line crew credit” does not include payments made to:

- Below-the-line crew who are producers, directors, screenwriters, cast and production assistants; and

- Loan out companies;

- Modifies the amount of below-the line nonresident wages that may qualify, for a NMFP production company prior to July 1, 2028, to be up to 100% of the amount of wages of resident below-the-line wages claimed, provided that the film production company provides a seventy-two-hour notice of the opportunity to be hired as resident below-the-line crew;

- Stipulates that for a film production company that is not a NMFP and, beginning July 1, 2028 for a NMFP:

- The total eligible wages for below-the-line nonresident crew will be limited to not more than 15% of the production’s total New Mexico budget for below-the-line crew wages;

- The film production company may claim the nonresident below-the-line crew credit for employing up to the following numbers of nonresident below-the-line crew positions (not to exceed 20), if the production’s final New Mexico budget is:

- Up to $2.75 million, five positions;

- Greater than $2.75 million and up to $7.5 million, ten positions;

- Greater than $7.5 million and up to $11 million, fifteen positions;

- In excess of $11 million, one position for every $10 million in addition to the number of positions aforementioned; and,

- Five positions in addition to the number of positions provided for above for a television pilot that has been ordered to series, provided the series is intended to be produced in New Mexico.

- Eliminates:

- The ability to qualify up to 20% the amount of below the line resident labor for the nonresident below-the-line credit; and,

- The requirement to make a financial or promotional contribution if applying for the below the line nonresident credit.

These changes apply to film production companies that commence principal photography for a film or commercial audiovisual project on or after July 1, 2023.

Utah

On March 23, 2023, Governor Spencer Cox signed Senate Bill 153, amending the Utah film production incentives program as follows:

- Creates an additional pool of funds for fiscal years (July 1 – June 30) 2023 and 2024 in the amount of $12 million per fiscal year to be used for rural productions only. This funding is in addition to the unrestricted annual funding of $6,793,700; and,

- Further defines a “rural production” to include a state-approved production in which at least 75 percent of the total number of production days occur within a county of the second class that has a national park within or partially within the county’s boundaries.

ON THE GOVERNOR'S DESK

Awaiting Signature

Maryland

Senate Bill 452 is on Governor Wes Moore’s desk and if signed would amend the Maryland Film Production Activity Tax Credit program as follows:

- Expands eligible projects to include a documentary, a talk, reality, or game show, or a live event;

- Modifies direct costs to now include salaries, wages, or other compensation for writers, directors, or producers domiciled in Maryland;

- Increases the tax credit incentive, as follows:

- For a television series, from 27% to 30% of the total qualified direct costs;

- For a Maryland small or independent film entity, from 25% to 28% of the total qualified direct costs, not to exceed $125,000; and,

- From 25% to 28% of the total qualified direct costs for all other types of productions;

- Increases the program’s annual funding, as follows:

- For fiscal years (7/1 – 6/30) 2023 and 2024, $12 million per fiscal year;

- For fiscal years 2025 through 2028, $25 million per fiscal year; and,

- For fiscal years 2029 and each fiscal year thereafter, $12 million per fiscal year.

If signed by the Governor, this Act will take effect on July 1, 2023 and shall be applicable to all taxable years beginning after December 31, 2022.

PROPOSED LEGISLATION

Still in the House or Senate

Colorado

House Bill 1275 proposes to modify the Colorado performance-based incentive for film production program as follows:

- Qualifies the 1st $1 million of payments per calendar year per personal service corporation, made by a production company to a personal service corporation to pay the wages or salaries of an employee-owner for the personal service corporation who participate in the production activities;

- Requires any production company that makes a payment for services to any personal services corporation, to file an information return in a form prescribed by the Department of Revenue;

- Exempts payments to a personal service company from Colorado income tax withholding IF the production company’s information return allows taxpayer identification number verification through the taxpayer identification number matching program administered by the IRS for the personal service corporation;

- Allows the state income tax withholding by a production company from a personal service corporation to be treated as an employer withholding from an employee; and

- Requires production companies to deduct and withhold state income tax at the rate set forth in Section 39-22-104 OR 39-22-301 if the personal service corporation:

- Fails to provide a validated taxpayer identification number; or

- Provides an IRS issued taxpayer identification number for nonresident aliens.

If enacted, the changes related to the withholding requirements apply to income tax years commencing on or after January 1, 2024.

Minnesota

House Bill 1938 proposes to amend Minnesota’s Film Production Tax Credit program as follows:

- Amends the minimum spend requirement of a film project from the previous definition of at least $1 million in the taxable year, to at least $1 million in a consecutive 12-month period beginning when expenditures are first paid in Minnesota for eligible production costs;

If enacted, the above section is effective for taxable years beginning after December 31, 2022.

- Increases program’s funding from $4.950 million per calendar year to $24.950 million per calendar year; and,

- Extends the sunset date from December 31, 2024, to December 31, 2032.

If enacted, the above section will be effective for allocation certificates issued after December 31, 2022.

Montana

Senate Bill 14 proposes to amend the Montana Media Production tax credit program as follows:

- Allows for a credit equal to 30% of compensation paid to each crew member or production staff member who is a Montana resident who is a veteran, or an enrolled member of an Indian tribe recognized by the state, not to exceed $10,000 in credits per person;

- Increases program funding to $20 million per calendar year; and

- Extends the program sunset date to December 31, 2031.

If enacted, this Act applies retroactively to income tax years beginning on or after January 1, 2023.

Senate Bill 550 proposes to amend the Montana Media Production tax credit program by changing the loan out withholding requirement from the rate of 6.9% to the highest marginal rate in effect under 15-30-2103.

If enacted, this Act shall be effective January 1, 2024.

North Carolina

House Bill 301 proposes to amend The Film and Entertainment Grant Fund program as follows:

- Increases the grant’s percentage from 25% to 35% of the qualifying expenses if at least 75% of:

- Filming of the production; and,

- Where crew, cast, and offices of the production are both located in tier one and tier two areas, as defined in G.S. 143B-437.08;

- Increases the grant percentage from 25% to 30% of the qualifying expenses for all other qualified productions;

- Increases the amount of qualifying compensation paid directly or indirectly to each resident and nonresident from $1 million to $5 million;

- Increases the per project incentive cap that may be awarded to a feature-length film (theatrical viewing or made for television) from $7 million to $20 million per project; and,

- Unifies the minimum qualified spend requirement for a feature-length film for theatrical viewing and a movie made for television at $1 million;

If enacted, this Act shall take effect when it becomes law and applies to qualifying expenses for productions incurred on or after that date.

South Carolina

House Bill 4020 proposes to amend South Carolina Motion Picture Incentive Act as follows:

- Increases annual program funding from $10 million to $30 million per fiscal year (7/1 – 6/30); and,

- Allows any unused rebates to be carried forward for the next three tax years thereby increasing the annual limit in those subsequent years.

This act shall take effect upon approval by the Governor and first applies to tax years beginning after 2022.