THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

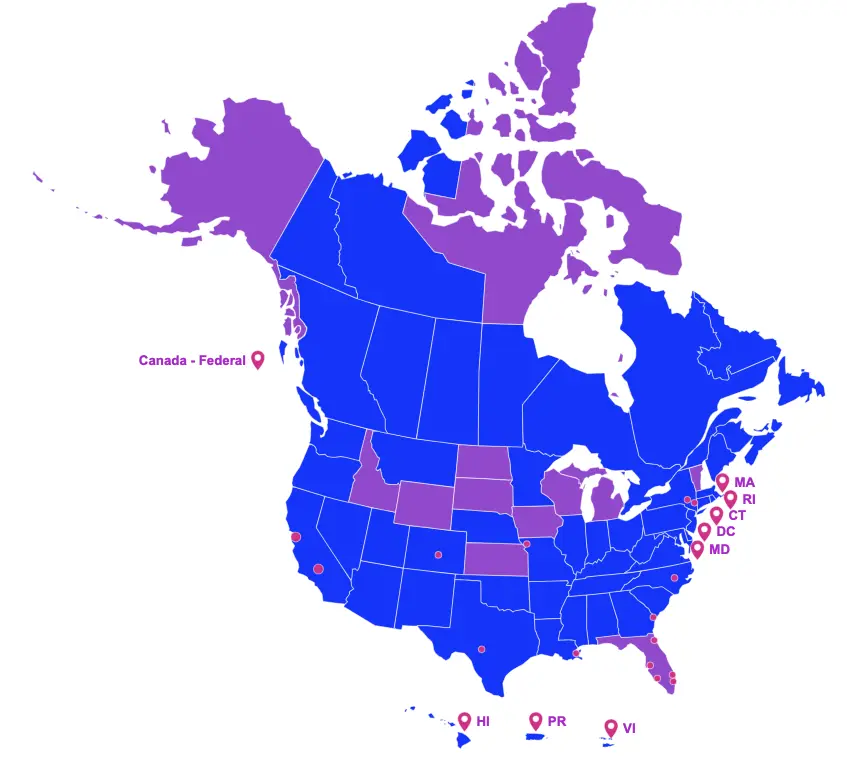

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

New York (A 9509) and (S 7509)

On April 3, 2020, Governor Cuomo signed Assembly Bill 9509 and Senate Bill 7509 which amend the Empire State Film Production and Postproduction tax credit programs for applications received on or after April 1, 2020, as follows:

- Reduces the film production credit to 25% of qualified expenses, previously 30%;

- Reduces the credit on qualified postproduction costs incurred at a qualified postproduction facility located within the state, but outside the metropolitan commuter transportation district (MCTD), to 30%, previously 35%;

- Reduces the postproduction only credit to 25% of qualified postproduction costs incurred at a qualified postproduction facility within the MCTD, previously 30%;

- Implements a minimum spend requirement, except for pilots, in the amount of:

- $1 million for projects with a majority of principal photography shooting days that take place within Westchester, Rockland, Nassau, or Suffolk counties or any of the five boroughs of New York City;

- $250,000 for projects shooting the majority of principal photography days in any other New York county;

- Excludes variety shows, except those that are relocated television productions, from the definition of a qualified project; and,

- Extends the sunset date to December 31, 2025, previously December 31, 2024.

The Act shall take effect immediately.

Rhode Island (H 7247) and (S 2326)

On March 17, 2020, Governor Raimondo signed House Bill 7247 and Senate Bill 2326 which amend the Rhode Island motion picture production tax credit program as follows:

- Allows qualified productions that do not film at least 51% of total principal photography days within the state to be eligible for the incentive provided they incur and pay a minimum of ten million dollars ($10,000,000) in state certified production costs within a twelve (12) month period.

This Act will take effect upon passage.

Utah (S 81)

On March 30, 2020, Governor Herbert signed Senate Bill 81 which amends the Utah cash rebate incentive as follows:

- Eliminates the $500,000 per project cap under the rebate program.

ON THE GOVERNOR'S DESK

Awaiting Signature

Maryland (H 152) and (S 192)

House Bill 152 and Senate Bill 192 are now on the Governor’s desk. They propose to amend the Maryland Film Activity tax credit as follows:

- Reduces the annual funding cap to $12 million for fiscal year 2021 (7/1–6/30) and each fiscal year thereafter.

PROPOSED LEGISLATION

Still in the House or Senate

Colorado (H 1354)

House Bill 1354 proposes to create the Colorado Film, Television, and Media Production tax credit program. Details are as follows:

- Establishes a transferable tax credit of up to 22% of qualified local expenditures in a “prioritized area,” defined as, a municipality or county with a population of less than 150,000 that is not a part of the Denver-Aurora-Boulder combined area or the Colorado Springs metropolitan area;

- Establishes a transferable tax credit of up to 18% of qualified local expenditures for a project not occurring in a “prioritized area”;

- Establishes an annual funding cap of $5 million per income tax year;

- Qualifies up to the 1st $1 million in salaries and wages of each resident and nonresident worker;

- Requirements:

- Workforce must be made up of at least 50% Colorado residents;

- Complete the project within two years of the conditional approval date;

- Provide an audit by a pre-approved certified public accountant;

- Credit transfers must be $50,000 or more; and,

- Establishes a sunset date of December 31, 2025.

If passed, the Act shall take effect January 1, 2021.

Connecticut (H 5465)

House Bill 5465 proposes to amend the Connecticut film incentive program as follows:

- Provides that any credit sold, assigned or otherwise transferred, in whole or in part, to one or more taxpayers may also be claimed against the sales tax imposed under chapter 219 only if there is common ownership of at least fifty percent between such taxpayer and the eligible production company that sold, assigned or otherwise transferred such credit;

- The eligible production company or taxpayer claiming the credit against the sales tax may only claim ninety-two percent of the amount reflected on the production tax credit voucher; and,

- For production tax credit vouchers issued on or after January 1, 2021, all or part of any such credit may be claimed for the income year in which the production expenses or costs were incurred, or in the five immediately succeeding income years.

Minnesota (H 4373) and (S 3992)

House Bill 4373 and Senate Bill 3992 propose to create the Minnesota Film Production tax credit program. Details are as follows:

- Creates a refundable tax credit equal to 25% of the total qualified preproduction, production, and postproduction expenditures in addition to postproduction only costs;

- Allows additional credits to be earned provided certain requirements are met for the following:

- Standalone pilot intended for series television;

- Series television productions with an order of at least 6 episodes, with a minimum budget of $50,000 for each episode;

- Shooting on a qualified stage facility;

- Establishes an annual funding cap of $110 million per fiscal year (7/1–6/30);

- Allows the following labor to qualify:

- Payments for wages and fringe benefits to above-the-line and below-the-line Minnesota residents:

- May earn an additional 5% of the total wages and salaries of resident producers, writers, directors, and crew who also filed a Minnesota income tax return as a resident in the two previous taxable years;

- Payments of wages and per diem for a nonresident performing artist;

- Limits the credit on total payments made for the services of resident and nonresident performing artists to $5 million;

- Payments for wages and fringe benefits to above-the-line and below-the-line Minnesota residents:

- Allows a maximum of $20 million of unutilized funds to rollover into the subsequent year for fiscal years 2021 – 2023 (7/1–6/30);

- Requires a CPA audit for credit claims in excess of $5 million;

- Disburses credit claims as follows:

- Claims of $2 million or less are refunded for the taxable year in which the credit certificate was issued;

- Claims greater than $2 million but less than $5 million, are paid in two equal amounts, the first payment is made in the current year, and the second payment is made the following year; and,

- Claims of $5 million or more are paid in three equal amounts, with the first amount allowed in the current year, and the second and third payments made in the subsequent years;

- Allows the production to assign the credit to another taxpayer; and,

- Allows the credit to be claimed against the premiums tax with a carryforward of 10 years.

If passed, the Act shall take effect for taxable years beginning after December 31, 2020.

Oklahoma (S 1442)

Senate Bill 1442 proposes to amend the Oklahoma Film Enhancement Rebate Program as follows:

- Stipulates that as of the effective date of this act, the rebate may be no greater than 35% plus the 2% for the use of music created by an Oklahoma resident.

- Limits the claims for High Impact Productions (productions with at least $50 million dollars in costs, with at least one-third of the total costs deemed Oklahoma expenditures) to the availability of funds, previously, High Impact Productions were excluded from the cap; and,

- Allows the Oklahoma Film and Music Office to set specific additional requirements for any production designated as a High Impact Production.