THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

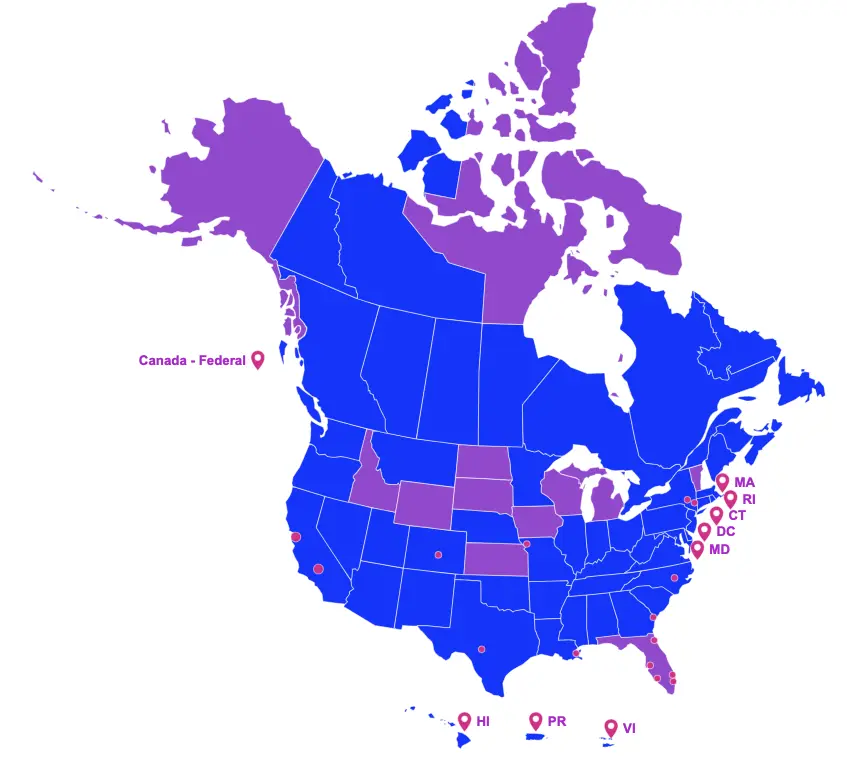

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ON THE GOVERNOR'S DESK

Awaiting Signature

Georgia

House Bill 1023 is currently on Governor Brian Kemp’s desk. If signed, it would tie the loan out withholding rate to the rate of the tax imposed on individuals.

This Act will become effective on July 1, 2024, and be applicable to all taxable years beginning on or after January 1, 2024.

PROPOSED LEGISLATION

Still in the House or Senate

Alabama

Senate Bill 285 proposes to amend the Entertainment Industry Incentive Act of 2009 as follows:

- Adds music albums to the definition of qualified productions;

- Requires a minimum spend of at least $30,000;

- Incentivizes the 1st $200,000 of expenditure in Alabama;

- Reserves $2 million of the fiscal year (10/1 – 9/30) funding exclusively for music albums beginning October 1, 2024;

- Allows for the funds reserved for albums to revert back to other qualified production companies in the event that applications are not received and incentives are not allocated for music albums by July 1 of each year; and,

- Renames the Alabama Film Office to Alabama Entertainment Office;

If enacted, this act shall become effective on June 1, 2024.

New York

Assembly Bill 7634 and Senate Bill 7422 propose to amend the Empire State Film Production Credit by excluding the following from the definition of a qualified film:

- A production which uses artificial intelligence or autonomous vehicles in a manner which results in the displacement of employees whose salaries are qualified expenses, unless such replacement is permitted by a current collective bargaining agreement covering such employees.

If enacted, this act shall take effect immediately.

Rhode Island

Senate Bill 2959 proposes to amend the Rhode Island Motion Picture Production Tax Credit program as follows:

- Increase the per project incentive cap from $7 million to:

- $10 million for calendar year 2025;

- $15 million for calendar year 2026;

- Appropriate annual funding in the amount of:

- $40 million for calendar year 2025;

- $50 million for calendar year 2026; and,

- Eliminate the program’s sunset date.