THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

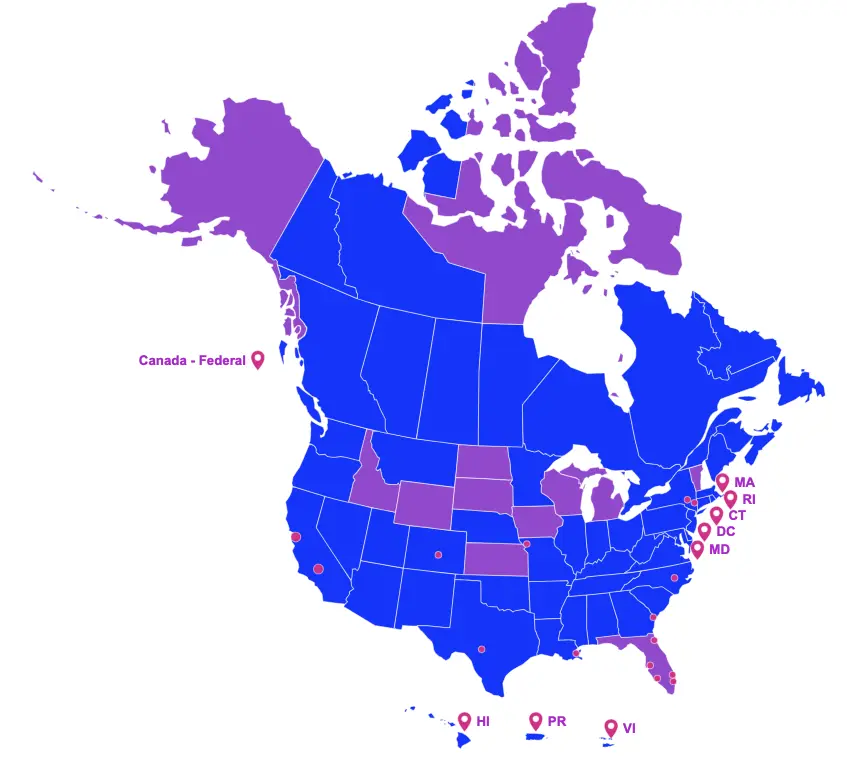

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

Japan

Japan launched a location incentive program for International Large-scale Audiovisual Productions (JLOX 2023). Details are as follows:

- Funds up to 50% of qualifying spend in Japan with a cap of one billion yen ($6.6M USD);

- Qualifies payments to residents;

- Projects must meet one of the two following requirements:

- Exceed 500 million yen in direct production costs in Japan OR exceed 1 billion yen in total production costs and more than 200 million yen in direct production costs in Japan;

- Be a project scheduled to be released, screened, broadcast, or distributed in more than ten countries or territories, AND exceed 200 million yen of direct production costs in Japan;

- Requirements:

- Applications should be submitted by a Japanese production group and production company;

- Applications from overseas will not be accepted;

- Applicants should have produced a TV or Film with an overseas production company;

- Project must be a benefit to local film industry;

- Project must promote the location where filming took place; and,

- Project must promote the appeal of Japan.

- Applications should be submitted by a Japanese production group and production company;

Utah

On March 21, 2024, Governor Spencer Cox signed House Bill 3, thereby authorizing the Governor’s Office of Economic Opportunity to issue tax credit certificates for rural productions in the amount of $12 million for fiscal year (7/1 – 6/30) 2025.

On March 21, 2024, House Bill 78 became law without Governor Spencer Cox’s signature, thereby amending the Utah rural film production funding by stipulating that beginning July 1, 2024, the office may issue tax credit certificates for rural productions in each fiscal year in an amount determined in the immediately preceding legislative session.

This bill takes effect on May 1, 2024.

PROPOSED LEGISLATION

Still in the House or Senate

Arizona

House Bill 2471 proposes to amend the Arizona Motion Picture Production incentives program by changing the incentive from a refundable tax credit to a nonrefundable nontransferable tax credit. It allows for the unused credit to be carried forward for five years.

Hawaii

House Bill 2005 proposes to amend the motion picture, digital media, and film production tax credit program by requiring that the taxpayer is given notice of and an opportunity to cure any failure to meet the requirements necessary to qualify for the tax credit.

House Bill 2747 proposes to establish the filmmakers special fund to award grants for films, media, and creative industries’ intellectual property development projects that are created and produced in Hawaii-by-Hawaii resident filmmakers. Details are as follows:

-

- Repeals the Hawaii film and creative industries development special fund and transfer funds to a newly established filmmakers special fund;

- Appropriates an amount yet to be determined for the 2025 fiscal year (7/1 – 6/30); and,

- Stipulates that all unexpended and unencumbered moneys remaining in the Hawaii film and creative industries development special fund as of the effective date of this Act shall be transferred to the filmmakers’ special fund as of that date.

Senate Bill 3049 proposes to amend the Motion Picture, Digital Media, and Film Production Income Tax Credit as follows:

- Increases the yearly annual funding cap from $50 million to $60 million per year;

- Modifies the definition of a qualified production to include:

- A television pilot, inclusive of broadcast and streaming platforms, as defined;

- For a single season, up to twenty-two episodes for broadcast television and up to eight episodes for an ongoing series for streaming platforms;

- If the number of episodes per single season exceed the above number, additional episodes for the same season shall constitute a separate qualified production;

- Stipulates that if the qualified production costs of a taxpayer exceed $1 million in a taxable year, then a written, sworn statement shall be accompanied by an independent third-party certification, performed by a qualified certified public accountant, no later than 90 days following the end of each taxable year in which qualified production costs were expended;

- Establishes a general excise tax exemption for certified development of film studio facilities in Hawaii; and,

- Extends the sunset date of the program thru December 31, 2038.

If enacted, this act shall take effect on January 1, 2025, and apply to expenditures made after December 31, 2024.

Illinois

House Bill 3431 proposes to amend the Film Production Services Tax Credit Act for all productions accredited on or after July 1, 2023, as follows:

- Allows for an additional 5% credit on wages paid to individuals who reside outside of the City of Chicago and any part of the state located within 30 miles of the city;

- If the person is a resident of a geographic area of high poverty or high unemployment and also resides outside of the metropolitan area, then the additional credit is 20% of wages paid to said individuals;

- Increases the amount of each applicable tax credit by 5% if 50% or more of the total hours of principal filming or taping of the production are completed in the State but outside of the metropolitan area, as determined by the Department;

- 30% credit becomes 35%;

- 15% credit becomes 20%;

- 5% credit becomes 10%;

- Qualifies a reality competition production as an accredited production;

- Excludes a talk show produced for local or regional markets from the definition of an accredited production; and,

- Eliminates the sunset date of the program.

If enacted, this act shall take effect upon becoming law.

House Bill 3616 proposes to amend the Film Production Services Tax Credit Act for all productions accredited on or after the effective date of this amendatory act, as follows:

- Stipulates that an accredited production may not include intense or persistent depictions of firearm violence, as defined;

- Provides for the recapture of credits if the production includes intense or persistent depictions of firearm violence;

- Requires productions, as part of the application process to:

- Certify that the production will not include intense or persistent depictions of firearm violence; and,

- Agree that, if the Department determines that the production does include intense or persistent depictions of firearm violence, the Department may void the tax credit agreement and recapture any credit amounts previously awarded to the applicant for that particular production.

If enacted, this act shall take effect upon becoming law.

Iowa

House Bill 2662 proposes to establish the Iowa film production incentive program, details of the program are as follows:

- Establishes a rebate equal to 30% of qualified expenditures, excluding any sales, use, and hotel and motel taxes paid;

- Limits the cumulative value of rebates that may be claimed thru June 30, 2026 by qualified production facilities to $10 million;

- Requirements:

- Have production budget of at least $1 million and evidence the production budget is fully funded;

- Provide written acknowledgment from the qualified production facility that no qualified expenses were incurred prior to approval of the application by the authority;

- Submit an audit report audited by a certified public accountant located in Iowa; and,

- Establishes a sunset date of June 30, 2026.

Tennessee

House Bill 2973 proposes to appropriate $5 million to the Tennessee Film and Television Incentive Fund for the 2025 fiscal year (7/1 – 6/30) and authorizes the Commissioner of Finance and Administration to carry forward unexpended balances of any appropriations made for the incentive fund, and the unexpended grant balances of the Tennessee Entertainment Commission

If enacted, this act takes effect July 1, 2024.

Wisconsin

Assembly Bill 1125 proposes to create a refundable tax credit for nonpayroll expenditures and a transferable tax credit for certain payroll expenditures, details are as follows:

- Establishes a transferable tax credit equal to 25% of the first $250,000 of salary or wages paid to each resident employee for services rendered in Wisconsin, excluding the salary or wages paid to the 2 highest-paid employees, if the budgeted production expenditures are $1,000,000 or more;

- Establishes a refundable tax credit equal to 25% of nonpayroll expenditures, as defined;

- Establishes a transferable credit equal to the sales/use taxes that the production company paid in the taxable year;

- Appropriates $5 million per fiscal year to the program;

- Establishes a per project incentive cap of $1 million per fiscal year (7/1 – 6/30);

- Requirements:

- Aggregated salaries and wages included in the cost of production for the period ending 12 months after the month in which principal photography begins must exceed $100,000 for a production that is 30 minutes or longer, or $50,000 for a production that is less than 30 minutes; and,

- Include an acknowledgment to the state of Wisconsin and the state film office as designed by the state film office, including a logo designed by the state film office, in the credits.

If enacted, this program would pertain to costs incurred after December 31, 2023.