THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

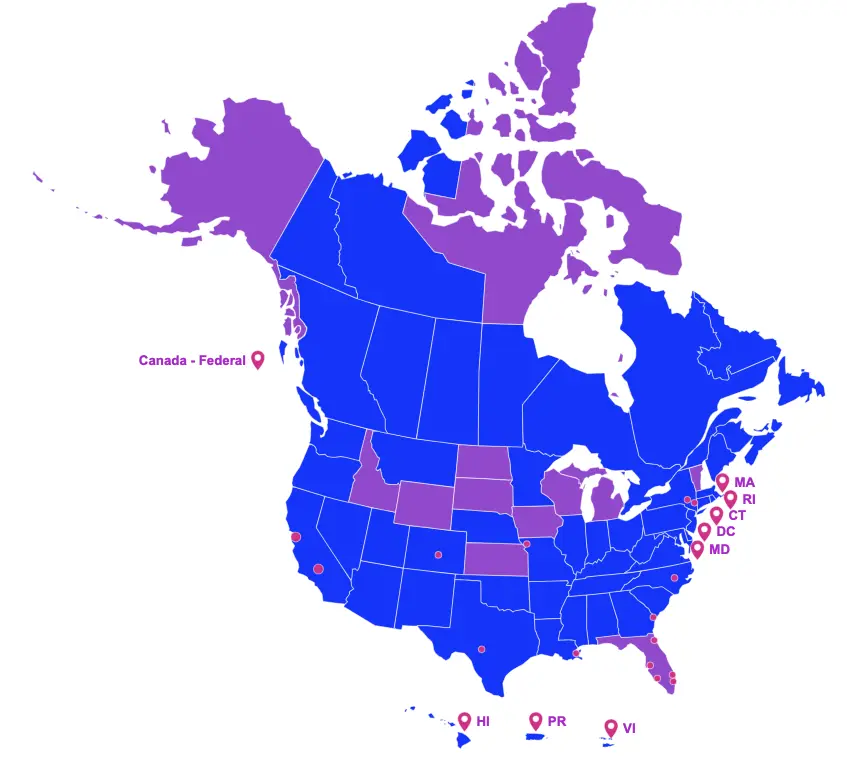

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

PROPOSED LEGISLATION

Still in the House or Senate

Georgia

House Bill 1180 proposes to amend the Georgia Entertainment Industry Investment Act, as follows:

- Increases the minimum base investment requirement from $500,000 to $1 million for a single state certified production;

- Requires a state certified production to meet at least four of the following criteria to earn the additional 10% tax credit:

- At least 50% of the crew performing services in the state are Georgia residents;

- At least 50% of the vendors providing goods or services in the state are Georgia vendors;

- Incur at least $30 million of production expenditures in Georgia;

- At least 50% of photography days occur in one or more rural counties as defined in Code Section 48-7-40.17;

- At least 50% of total photography days in studio facilities are in studio facilities in Georgia;

- At least 50% of total photography days in studio facilities are in studio facilities in the state, or, with respect to such production, the company enters into a long-term lease with a studio facility in this the in a scope and duration approved by the Department of Economic Development based on the value of the lease relative to the amount of tax credit sought;

- The company agrees to contract with Georgia vendors for 20% of the production’s postproduction expenditures or contracts with Georgia vendors for 20% of the production’s visual effects expenditures;

- The company participates in at least one Georgia workforce development program, including, but not limited to, a Georgia Film Academy program; or

- The company includes a qualified Georgia promotion or engages in alternative marketing opportunities approved by the Department of Economic Development based on a determination that such activities offer promotional value to the state equal to or greater than the promotional value of a qualified Georgia promotion;

- Limits the dollar amount of film tax credits that may be transferred during a calendar year to 2.5% of the Governor’s revenue estimate for the corresponding fiscal year;

- Stipulates that if the amount of actual tax credits exceeds 2.5% of the Governor’s estimated revenue, the revenue commissioner will prorate the amount of credits that may be transferred; and,

- Allows the amount that is unclaimed because of the above proration to be carried forward to the following year and is not subject to any further proration in that year.

If enacted, this Act shall become effective on January 1, 2026, and shall be applicable to taxable years beginning on or after such date.