THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

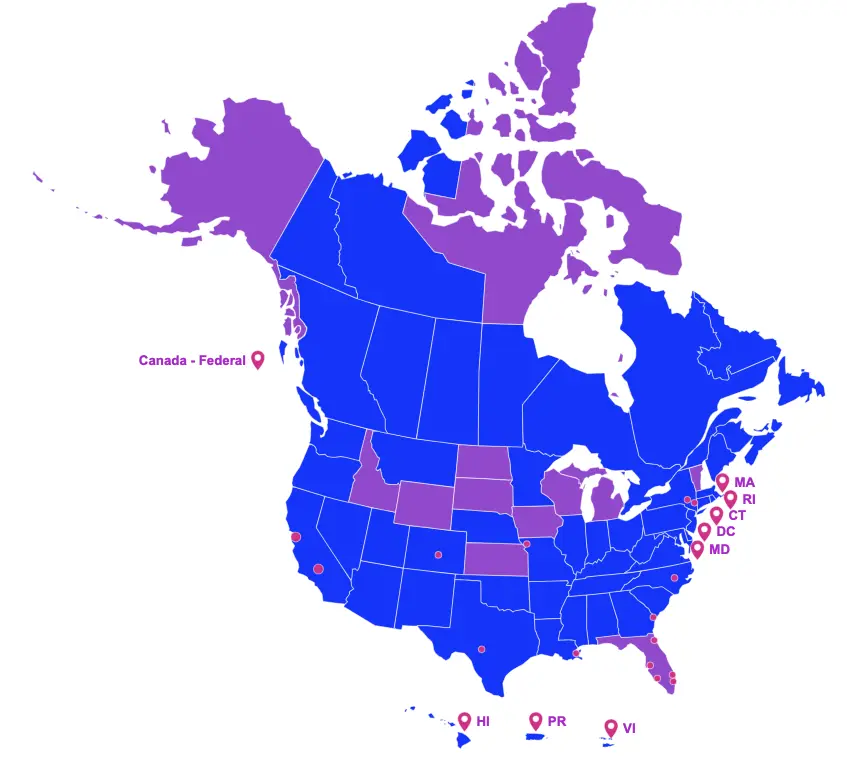

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

Illinois

On April 19, 2022, Governor Kathy J. B. Pritzker signed Senate Bill 157, amending the Film Production Services Tax Credit Act as follows:

For productions commencing on or after July 1, 2022:

- Increases the amount of qualifying wages from the first $100,000 to the first $500,000 paid to each resident and nonresident;

- Only wages paid to nonresidents working in the following positions shall be considered Illinois labor expenditures:

- Writer, Director, Director of Photography, Production Designer, Costume Designer, Production Accountant, VFX Supervisor, Editor, Composer, and Actor;

- Only wages paid to nonresidents working in the following positions shall be considered Illinois labor expenditures:

- Limits the number of nonresident actors’ wages that may qualify as Illinois labor as follows:

- For productions with Illinois spending of $25 million or less no more than two nonresident actor’s wages shall qualify;

- For productions with Illinois spending of more than $25 million no more than four nonresident actor’s wages shall qualify;

For productions commencing on or after July 1, 2023:

- Requires the transferor to pay a fee equal to 2.5% of the transferred credit associated with nonresident wages and an additional fee of 0.25% of the transferred credit that is not associated with nonresident wages on all transfers that take place on or after July 1, 2023.

PROPOSED LEGISLATION

Still in the House or Senate

Colorado

House Bill 1408 proposes to modify the Colorado performance-based incentive for film production program as follows:

- Creates a film incentive task force to study how to make the performance-based incentive for film production in Colorado more effective;

- Allows for the executive director to authorize the approval or issuance of an incentive in an amount that exceeds the current statutory limit of 20% of qualifying local expenditures; and,

- Appropriates $2 million to the office of the governor from the Colorado office of film, television, and media operational account cash fund for FY23 (7/1 – 6/30).

Kansas

House Bill 2749 proposes to create the Kansas film production industry development act program, as follows:

- Establishes a refundable tax credit equal to 30% of qualified production expenditures for a certified project and allows for an additional bump of:

- Up to 5 percent of the qualified production expenditures for an eligible multi-film deal (as defined), eligible television series, a high-impact production (as defined) or contributions to film-related infrastructure or workforce development in Kansas; or

- Up to 5 percent of qualified production expenditures if 50 percent or more of the crew or above-the-line personnel are Kansas residents;

- Establishes a refundable tax credit equal to 30 percent of qualified postproduction expenses for a certified project with no qualified production expenses;

- Allows up to an additional 5 percent, of the amount of the qualified production expenditures or qualified postproduction expenditures, as applicable, of a certified project of a production company that has previously received an income tax credit under this act with respect to such certified project;

- Qualifies resident and nonresident above-the-line (to 25 percent of total production expenditures) and below-the-line labor costs;

- Allows up to $9 million per fiscal year (7/1 – 6/30) to be awarded;

- Requirements:

- For a television series with multiple episodes:

- Not less than 25 percent of the series season is filmed within Kansas and incurs a minimum of $50,000 in eligible expenses;

- At least 10 percent of total wages for crew is paid to residents;

- The amount paid to above-the-line personnel shall not comprise more than 25 percent of qualified production expenditures; and,

- For a television series with multiple episodes:

- Establishes a sunset date of December 31, 2026.

Minnesota

House Bill 3669 proposes to amend a definition within Minnesota’s Film Production Tax Credit program as follows:

- Requires the taxpayer spend at least $1 million in any consecutive twelve-month period (previously within the taxable year) for eligible production costs, provided that the taxpayer designates the months used for the period to the commissioner and does not designate a month previously designated.

If enacted, the change would be effective for taxable years beginning after December 31, 2021.

New York

Assembly Bill 10034 proposes to amend the empire state film production credit program as follows:

- Allows for television series commonly known as variety entertainment, that would otherwise be prohibited from receiving a tax credit, to be eligible for a new variety entertainment show credit if:

- the amount of the initial year credit does not exceed the previous year’s amount;

- at least 50 percent of the staff are maintained in the first year of the credit;

- the same eligible entity applies for the subsequent season’s credit; and,

- such application is made prior to March 31, 2023.

If enacted, this act shall take effect immediately.

Rhode Island

House Bill 8154 proposes to modify the Rhode Island Musical and Theatrical Production Tax Credits program as follows:

- Amends the definition of “Pre-Broadway production” for purposes of musical and theatrical production tax credits to include live stage productions performed in qualified production facilities having a presentation scheduled for Broadway’s theater district in New York City within thirty-six (36) months after its Rhode Island presentation rather than the previous period of twelve (12) months.

If enacted, this act would take effect upon passage.