THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

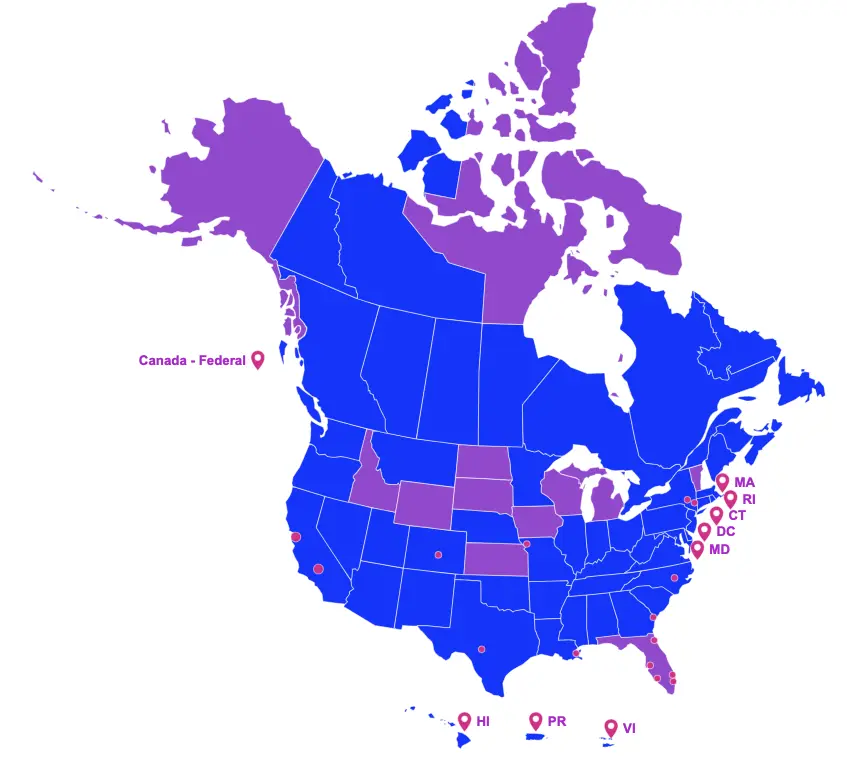

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

New York

On April 9, 2022, Governor Kathy Hochul signed Assembly Bill 9009 and Senate Bill 8009, amending the empire state film production credit and the empire state film postproduction credit, and creating the empire state digital gaming media production credit; details of the legislation are as follows:

Empire state film production credit and film postproduction credit:

- Stipulates that beginning January 1, 2023, a qualified film production company or qualified independent film production company applying for credit shall, as a condition for the granting of the credit, file a diversity plan with the governor’s office for motion picture and television development outlining specific goals for hiring a diverse workforce;

- Extends sunset date to December 31, 2029;

- Provides that for tax credit certificates issued on or after January 1, 2023, the amount of credit shall be reduced by one-half of one percent allowed to the taxpayer;

Empire state digital gaming media production credit:

- Establishes a refundable tax credit equal to 25 percent of qualified digital gaming media production costs of one or more qualified digital gaming media productions, beginning on January 1, 2023;

- Allows for an additional 10 percent of eligible costs incurred in this state but outside the metropolitan commuter transportation district, as defined;

- Establishes an annual incentive funding cap of $5 million;

- Limits the maximum credit that may be earned by a single project to $1.5 million per year;

- Qualifies the first $100k of wages paid to each individual other than actors and writers;

- Salaries of CEO, CFO, President, Treasurer, etc. are not eligible if the media production company has more than ten employees;

- Requirements:

- Include end credit language and logo acknowledging the state’s role in the creation of the production;

- File a diversity plan with the department of economic development outlining specific goals for hiring a diverse work force;

- Have a minimum spend of $100k;

- At least 75 percent of total production costs must be incurred and paid within New York state; and,

- Establishes a sunset date of December 31, 2027.

ON THE GOVERNOR'S DESK

Awaiting Signature

Illinois

Senate Bill 157 is on Governor J. B. Pritzker’s desk and if signed would amend the Film Production Services Tax Credit Act as follows:

For productions commencing on or after July 1, 2022:

- Increases the amount of qualifying wages from the first $100,000 to the first $500,000 paid to each resident and nonresident;

- Only wages paid to nonresidents working in the following positions shall be considered Illinois labor expenditures:

- Writer, Director, Director of Photography, Production Designer, Costume Designer, Production Accountant, VFX Supervisor, Editor, Composer, and Actor;

- Only wages paid to nonresidents working in the following positions shall be considered Illinois labor expenditures:

- Limits the number of nonresident actors’ wages that may qualify as Illinois labor as follows:

- For productions with Illinois spending of $25 million or less no more than two nonresident actor’s wages shall qualify;

- For productions with Illinois spending of more than $25 million no more than four nonresident actor’s wages shall qualify;

For productions commencing on or after July 1, 2023:

- Requires the transferor to pay a fee equal to 2.5% of the transferred credit associated with nonresident wages and an additional fee of 0.25% of the transferred credit that is not associated with nonresident wages on all transfers that take place on or after July 1, 2023;

Maryland

Senate Bill 536 is on Governor Larry Hogan’s desk and if signed would amend the Maryland Film Production Activity Tax Credit program by expanding eligibility for the credit against the State income tax for certain film production activities to include digital animation projects.

If signed by the Governor, this Act will take effect on July 1, 2022 and shall be applicable to all taxable years beginning after December 31, 2021.