THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

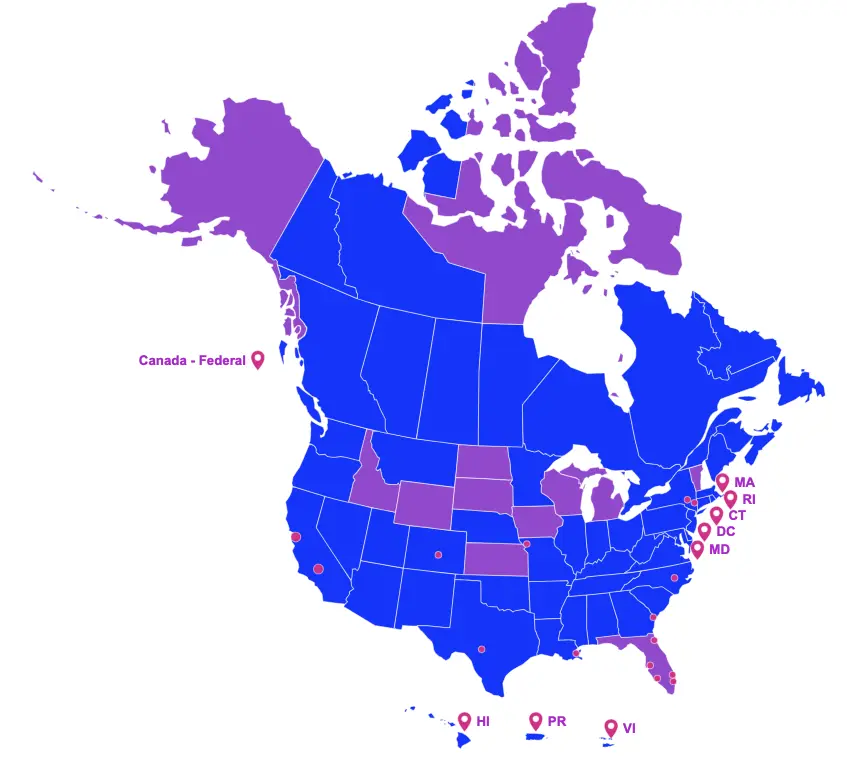

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ON THE GOVERNOR'S DESK

Awaiting Signature

Indiana

Senate Bill 361 is on Governor Eric Holcomb’s desk and if signed would create the Indiana Film and Media Production Tax Credit program, to be managed by the Indiana Economic Development (IED). Details of the program are as follows:

- Creates a nonrefundable and nontransferable tax credit equal to a percentage, to be determined by IED, that may not exceed 30 percent;

- Establishes a sunset date of July 1, 2027; and,

- Allows for a nine-year carryover of the credit.

Oregon

Senate Bill 1524 is on Governor Kate Brown’s desk and if signed would amend the Oregon Production Investment Fund Program, as follows:

- Increases the expense reimbursement percentages for each fiscal year (July 1 – June 30) beginning on or after July 1, 2022 to:

- 20 percent (from 10 percent) of payments made for employee salaries, wages and benefits for work done in Oregon; and,

- 25 percent (from 20 percent) of all other actual Oregon expenses.

If enacted, this act shall take effect on the 91st day after the date on which the 2022 regular session of the Eighty-first Legislative Assembly adjourns sine die.

Utah

Senate Bill 49 is on Governor Spencer Cox’s desk and if signed would amend the Utah film production incentives program as follows:

- Creates an additional pool of funds for a fiscal year (July 1 – June 30) beginning on or after July 1, 2022 thru June 30, 2024 in the amount of $12 million to be used for rural productions only. This funding is in addition to the unrestricted ongoing funding of $6,793,700 for each fiscal year after June 30, 2022; and,

- Defines a “rural production” as a state-approved production in which at least 75 percent of the total number of production days occur within a county of the third, fourth, fifth, or sixth class.

Washington

House Bill 1914 is on Governor Jay Inslee’s desk and if signed would amend the Washington Motion Picture Competitiveness program as follows:

- Increases the annual incentive funding cap from $3.5 million to $15 million per calendar year;

- Establishes an enhancement award of up to 10 percent on a motion picture production’s state investment for motion pictures that are:

- Located or filmed in a “rural community”, as defined; or

- That tell stories of marginalized communities;

- Establishes funding assistance of up to $3 million for small motion picture productions produced in Washington state, if:

- The small motion picture production is creatively driven by Washington residents;

- Must demonstrate that the amount of the total actual investment for the production is less than $1 million; and,

- Must have at least two Washington residents in any combination of the following positions:

- Writer, director, producer, or lead actor;

- Extends the sunset date thru June 30, 2030.

West Virginia

House Bill 2096 is on Governor Jim Justice’s desk and if signed would reinstate the West Virginia Film Industry Investment Act, as follows:

- Establishes a transferable base tax credit of 27 percent;

- Allows for an additional 4 percent to be earned on all qualified expenditures if the eligible company employs 10 or more West Virginia residents as full-time employees working in the state or as apprentices working in the state;

- Incentivizes:

- Payments of wages (without limitation) that are subject to West Virginia tax;

- Payments made to a loan out company (without limitation) that are subject to West Virginia income tax;

- Nonpayroll expenditures that occur in West Virginia or with a West Virginia vendor;

- Establishes:

- A sunset date of December 31, 2027;

- An unlimited annual funding cap;

- An unlimited per project cap;

- Requirements:

- Incur a cumulative amount of $50,000 in a calendar year in direct production expenditures and post-production expenditures;

- Submit an expense verification report, using Agreed Upon Procedures, prepared by an independent certified public accountant; and,

- Recognize the State of West Virginia in the end credit roll.

If signed by the Governor this program shall apply to all taxable years beginning on or after July 1, 2022.