THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

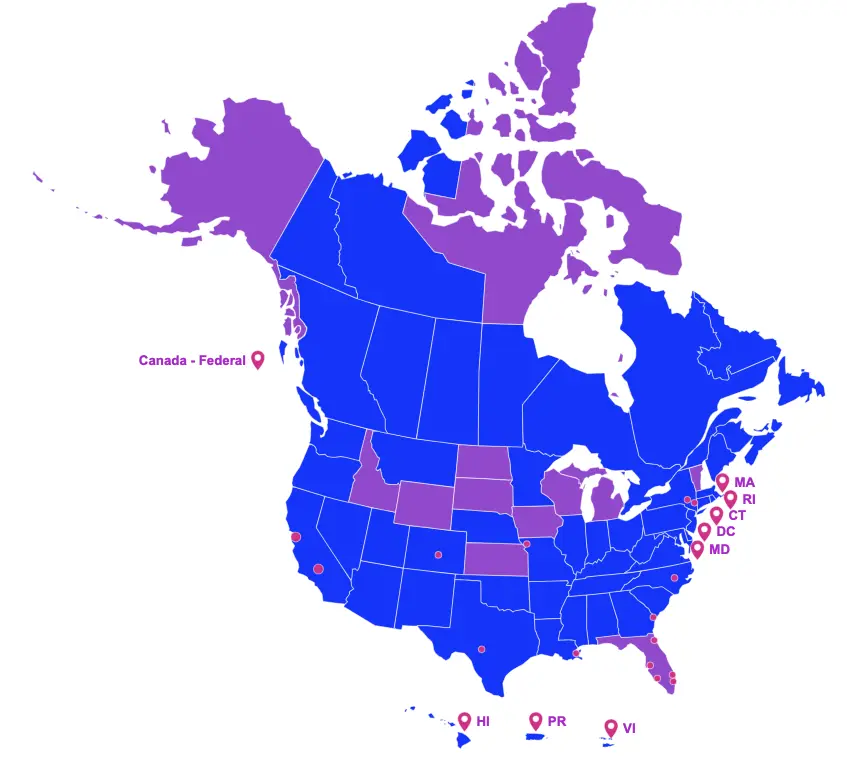

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

PROPOSED LEGISLATION

Still in the House or Senate

Arizona

Senate Bill 1708 proposes to create the Arizona Motion Picture Production incentives program by offering a refundable tax credit for qualified productions, as follows:

- Provides for the following tax credits on “qualified expenditures”, as defined:

- 15 percent for a motion picture production company that spends up to $10 million;

- 17.5 percent for a motion picture production company that spends more than $10 million but less than $35 million;

- 20 percent for a motion picture production company that spends more than $35 million;

- Allows for additional bumps, as follows:

- 2.5 percent on below-the-line resident labor costs;

- 2.5 percent of the total amount of qualified production costs if:

- The production company uses a qualified production facility in the state to produce the motion picture production; or,

- The production company films primarily on location, produces and films the project primarily in Arizona AND performs ALL preproduction, postproduction and editing at an in-state qualified production facility;

- 2.5 percent of the total amount of qualified production costs if the production is produced and filmed in association with a long-term tenant, as defined, of a qualified production facility;

- Qualifies resident and nonresident above-the-line and below-the-line labor costs;

- Appropriates $150 million for each calendar year of which no more than $25 million may be used for projects that qualify by filming primarily on location in Arizona and performs ALL preproduction and postproduction and editing at an in-state facility, if available;

- Requirements:

- To qualify for the program a motion picture must do either of the following:

- Use an in-state qualified production facility to produce the motion picture production; or

- If the motion picture is filmed primarily on location, produce and film primarily in-state and perform ALL preproduction, postproduction, and editing at a facility in-state, if a facility is available;

- Maintain the production company’s full-time production labor positions in Arizona;

- Include acknowledgment that the production was filmed in Arizona in the credits; and,

- Submit an audited statement completed by a state certified public accountant.

- To qualify for the program a motion picture must do either of the following:

Florida

Senate Bill 946 creates the Targeted High Wage Production Program for qualified productions that provide the highest return on investment and economic benefit to the state. Details of the program are as follows:

- Establishes a transferable tax credit of up to 20 percent of qualified expenditures;

- Allows for an additional 3 percent to be earned if:

- 60 percent of the project’s production in Florida takes place in an underutilized area; or

- its content is deemed family friendly;

- Allows for an additional 3 percent to be earned if:

- Qualifies in-state nonpayroll spend and the 1st $200,000 paid to each above-the-line and below-the -line Florida resident;

- Limits the maximum incentive that may be earned by a single project to $2 million;

- Appropriates annual funding of $20 million per fiscal year (July 1 – June 30) through fiscal year 2026;

- Requirements:

- Project minimum qualified spend of at least:

- $1.5 million for a film and digital media project;

- $500,000 per episode for a television series;

- Project that at least 60 percent of the employed crew, including cast and stand ins, but not including extras, will be made up of residents and at least one member will be a veteran;

- Project at least 70 percent of its total production days will be in Florida;

- Not receive a sales tax certificate of exemption for the project; and,

- Each application must be audited by an independent certified public accountant licensed by the state; and,

- Project minimum qualified spend of at least:

- Establishes a sunset date of June 30, 2026.

This act shall take effect upon becoming law.

Hawaii

House Bill 2087 and Senate Bill 3055 propose to extend the sunset date of the motion picture, digital media, and film production income tax credit from December 31, 2025, to December 31, 2031.

This act shall take effect upon approval.

Senate Bill 2079 proposes to amend the motion picture, digital media, and film production tax credit program as follows:

- Establishes a withholding requirement by persons claiming the motion picture, digital media, and film production income tax credit on all payments to loan out companies for services performed in the State;

- The amount withheld shall equal the general excise tax rate on manufacturing or producing, plus the applicable rate of county surcharge on general excise tax;

- The amount withheld shall be remitted to the department of taxation to the credit of the general excise tax account of the loan out company to whom the qualified production costs were paid or will be paid; and,

- The amounts withheld shall be allocated to the tax required to be paid by the loan out company’s employees performing services in Hawaii.

This Act shall take effect on July 1, 2022 and shall apply to payments made to a taxpayer or loan out company after June 30, 2022.

Indiana

Senate Bill 361 proposes to create the Indiana Film and Media Production Tax Credit program, which will be managed by the Indiana Economic Development (IED). The IED will determine the rate to be applied against qualified expenses. The tax credit earned will be nonrefundable and nontransferable.

If enacted, this act shall take effect July 1, 2023.

Kentucky

House Bill 201 proposes to amend the Kentucky Film and Entertainment Industry Incentive Program as follows:

- Reduces the annual incentive funding cap to $10 million for the calendar year 2023 and each calendar year thereafter; and,

- Provides that beginning January 1, 2023, an approved company may receive a nonrefundable tax credit.

New Mexico

Senate Bill 188 proposes to amend the New Mexico Film Production Tax Credit program by establishing a safety training requirement as follows:

- Requires all individuals employed by a film production company that has firearms or firearm ammunition physically located on the premises where filming is taking place to have a valid certificate of competency in the safe handling of firearms pursuant to the Hunter Training Act; and,

- Stipulates that a film production company that employs individuals not in compliance with the above provision shall not be eligible for tax credits pursuant to the Film Production Tax Credit Act, including film and television tax credits for the calendar year in which the violation occurs.

If enacted, this act shall take effect January 1, 2023.

Oregon

Draft Bill 161 proposes to increase expense reimbursement percentage allowed to single film or single local media production project from the Oregon Production Investment Fund (OPIF), as follows:

- Increases the incentive rate on qualifying payments made for employee salaries, wages and benefits for work done in Oregon from 10 percent to 20 percent;

- Increases the incentive rate on qualifying nonpayroll expenses from 20 percent to 25 percent; and,

- Applies to fiscal years beginning on or after July 1, 2022.

This 2022 Act takes effect on the 91st day after the date on which the 2022 regular session of the Eighty-first Legislative Assembly adjourns sine die.

Utah

Senate Bill 49 proposes to amend the Utah film production incentives program as follows:

- Defines “rural production” as: a state-approved production in which a majority of the production occurs within a county of the third, fourth, fifth, or sixth class; and,

- Clarifies that the incentive earned by a qualified “rural production” is exempt from the annual funding limits.

Washington

House Bill 1914 and Senate Bill 5760 propose to amend the Washington motion picture competitiveness program by increasing the annual incentive funding cap to $20 million per calendar year; previously the program had an annual incentive funding cap of $3.5 million per calendar year.

West Virginia

House Bill 2096 and Senate Bill 51 propose to reinstate the West Virginia Film Industry Investment Act, as follows:

- Establishes a transferable base tax credit of 27 percent;

- Allows for an additional 4 percent to be earned on all qualified expenditures if the eligible company employs 10 or more West Virginia residents;

- Allocates $10 million per fiscal year (July 1- June 30) to the incentive fund;

- Additional amounts may be allocated for a feature length film with West Virginia in the title or if the subject of the film is clearly identified as West Virginia;

- Requirements:

- Submit an expense verification report, using Agreed Upon Procedures, prepared by an independent certified public accountant; and,

- Recognize the State of West Virginia in the end credit roll.

Wyoming

Working Draft Bill 80 proposes to create the Wyoming film production incentives program offering monetary rebates for qualified productions in two tiers, as follows:

Tier 1:

- Defines Tier 1 projects as: full feature films, streaming and television series, commercials, documentaries, virtual reality products and multi-media and new media campaigns;

- Provides for a rebate of not more than 30 percent of “qualified expenditures”, as follows:

- 15 percent base rate on nonpayroll spend and below-the-line resident salaries and benefits, if;

- Qualified spend is at least $200,000; and,

- Not less than one million viewers are likely to be exposed to the production upon release, as substantiated through the entity’s distribution plan;

- Allows for an additional 5 percent if at least 60 percent the total number of people employed are Wyoming residents;

- Allows for an additional 5 percent upon demonstrating that a production’s postproduction work was primarily physically completed in the state;

- Allows for an additional 2.5 percent upon demonstrating that no less than seven million five hundred thousand viewers are likely to be exposed to the qualified production upon release;

- Allows for an additional 2.5 percent upon demonstrating that no less than 10 percent of the production’s crew were Wyoming resident veterans or Wyoming students 16 years of age or older;

- 15 percent base rate on nonpayroll spend and below-the-line resident salaries and benefits, if;

Tier 2:

- Defines Tier 2 projects as: commercials, infomercials, documentaries, short films, webisodes, video games, music videos, content-based mobile apps, virtual reality products, multi-media and new media campaigns, visual effects and standalone postproduction work;

- Provides for a rebate of not more than 15 percent of “qualified expenditures”, as follows:

- 10 percent base rate on nonpayroll spend and below-the-line resident labor, if;

- Qualified spend is at least $50,000; and,

- Not less than 60 percent of the production’s crew were Wyoming residents;

- Allows for an additional 5 percent upon demonstrating the production involves a Wyoming storyline or theme.

- 10 percent base rate on nonpayroll spend and below-the-line resident labor, if;

This act shall take effect July 1, 2022