THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

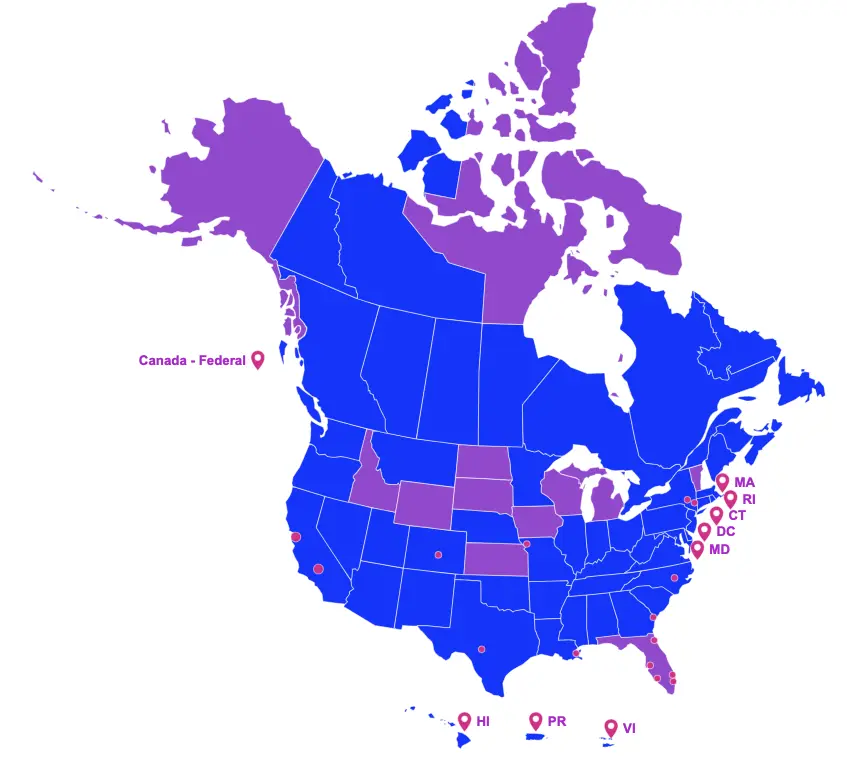

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ON THE GOVERNOR'S DESK

Awaiting Signature

Kentucky (H 249)

If House Bill 249 is signed by Governor Beshear, the following changes would be made to the current Kentucky Motion Picture or Entertainment Production Tax Credit Incentives Program:

- Changes the tax credit earned from nonrefundable to refundable;

- Reduces the annual funding cap from $100 million to $75 million per calendar year;

- Requirements:

- Begin production within six months of filing an application;

- Complete production within two years of the production’s start date;

- Closes the Kentucky Film Commission and transfers authority to the Kentucky Economic Development Finance Authority;

- The current enacted program allows for:

- 30% credit on qualifying nonresident labor and nonpayroll local spend;

- An opportunity to earn an additional 5% on all qualifying expenses when projects are filmed within an “enhanced county”;

- 35% credit on qualifying resident labor;

- Payroll expenditures paid to resident and nonresident below-the-line production crew; and,

- The 1st $1 million paid to each resident and nonresident above-the-line employee.

If signed, this Act will take effect for applications approved on or after January 1, 2022.

Utah (S 167)

Senate Bill 167 proposes to amend the Utah Motion Picture rebate program by increasing the annual funding from $6.79 million to $8,393,700 for fiscal year ending June 30, 2022.

PROPOSED LEGISLATION

Still in the House or Senate

Illinois (S 2181)

Senate Bill 2181 proposes to amend the Illinois Film Production Services tax credit program as follows:

- Allows all resident wages to qualify, previously limited to $100,000 per resident worker;

- Qualifies the 1st $500,000 of wages for each nonresident working in a “qualified” position (for a television series the nonresident limit is applied to the entire season);

- Defines “qualified” nonresident position as: writers, director, director of photography, production designer, costume designer, production accountant, VFX supervisor, editor, and composer;

- Allows nonresident actors’ wages to qualify as follows:

- For projects with Illinois production expenditures of:

- $25 million or less, no more than two nonresident actors’ wages shall qualify; and,

- More than $25 million, no more than four nonresident actors’ wages shall qualify;

- Establishes tax credit transfer fees as follows:

- 2.5 percent of the transferred credit that is related to qualified nonresident wages; and,

- 0.25 percent of the transferred credit that is not calculated on out-of-state wages.

- For projects with Illinois production expenditures of:

If enacted, the above changes would take effect for productions commencing on or after July 1, 2021.

Louisiana (H 36)

House Bill 36 proposes to amend the Louisiana Motion Picture Production tax credit program, for applications/claims submitted after July 1, 2021, as follows:

- Reduces the amount of film tax credits that may be issued by the Department of Economic Development from $150 million to $75 million per fiscal year (7/1 – 6/30);

- Reduces the amount of film tax credits that may be claimed on tax returns from $180 million to $80 million per fiscal year (7/1 – 6/30); and,

- Reduces the per project incentive cap from $20 million to $10 million;

- For scripted episodic content, the per project incentive cap is reduced from $25 million to $12.5 million.

Minnesota (H 1975) and (S 1986)

House Bill 1975 and Senate Bill 1986 propose to establish the Minnesota Film Production Credit program as follows:

- Creates a transferrable tax credit equal to 25 percent of qualified spend and labor;

- Requirements:

- Spend a minimum of $1 million in qualified spend and labor;

- Include an end credit promotion that reads, “Produced in Minnesota” or “Filmed in Minnesota”;

- Submit an audit performed by an independent certified public accountant;

- Establishes an annual funding cap of $25 million per calendar year; and,

- Establishes a sunset date of December 31, 2030.

If enacted, this program would be effective for taxable years beginning after December 31, 2020.

New York (S 5226)

Senate Bill 5226 proposes to add documentary films to the list of qualifying projects for the Empire State Film Production tax credit program.

If enacted, this amendment would take effect immediately and apply to taxable years beginning on or after January 1, 2021.

North Carolina (S 268)

Senate Bill 268 appropriates an additional $34 million for each year of the biennium ending June 30, 2023 to the North Carolina Film and Entertainment Grant Fund. This is in addition to the $31 million per fiscal year (July 1 – June 30).

Oklahoma (S 608)

Senate Bill 608 proposes to amend Oklahoma’s Compete with Canada Film Act as follows:

- For expenditures made after July 1, 2022:

- Reduces the base rebate from 35% to 19%;

- Allows additional incentive bumps as follows:

- 2% of documented expenditures if the production company spends at least $20,000 for the use of music created by an Oklahoma resident that is recorded in-state or for the cost of recording songs or music in-state;

- 2% for hiring two employees in coordination with the Oklahoma Works Employer Portal;

- 2% for displaying the state logo, as provided by the Oklahoma Film and Music Commission, in the film, television production, or commercial;

- 2% if the production company conducts principal photography outside at least a 50-mile radius from downtown Oklahoma City;

- 5% if the production company films at least one-third (1/3) of total principal photography days in-state; and,

- 5% if the production company produces multiple “films” for exhibition in a theater or at least 6 episodes of a “film” series in-state;

- Extends the sunset date from June 30, 2027 to June 30, 2035; and,

- Changes the name of the program to Oklahoma Film Incentive Act.

- Allows additional incentive bumps as follows:

- Reduces the base rebate from 35% to 19%;

If passed, the Act shall take effect November 1, 2021.

Pennsylvania (S 321)

Senate Bill 321 proposes to increase the annual funding cap from $70 million to $125 million per fiscal year (7/1 – 6/30) for the Pennsylvania Entertainment Production program.

Texas (H 1)

House Bill 1 appropriates $45 million to the Texas Moving Image Industry Incentive Program for the biennium ending 8/31/2023.