THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

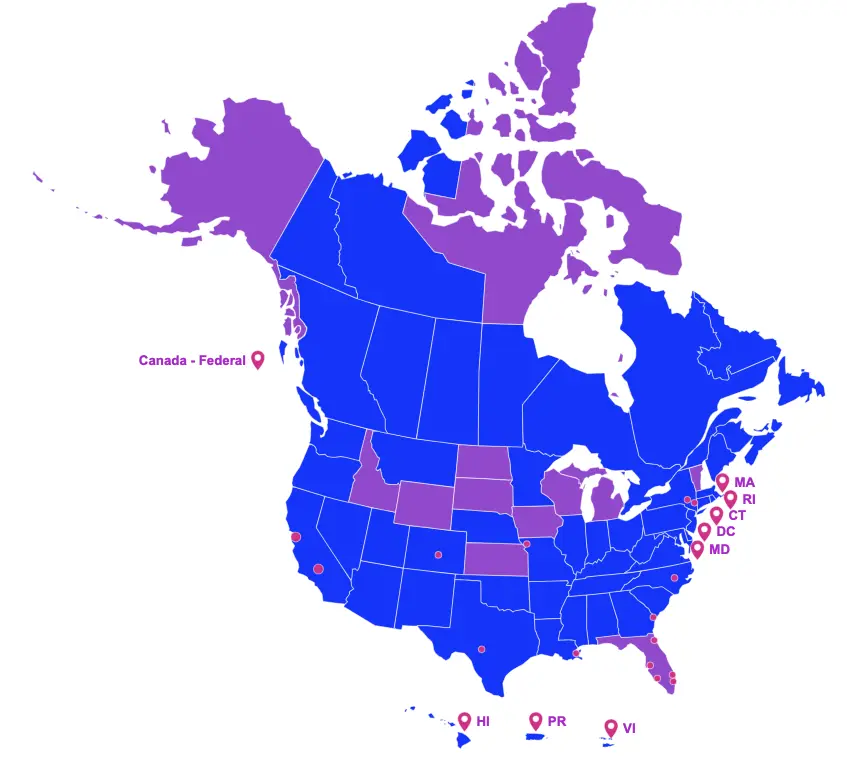

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

PROPOSED LEGISLATION

Still in the House or Senate

Kentucky (H 416)

House Bill 416 proposes to reduce the amount of tax credits that may be approved in a calendar year from $100 million to $10 million.

Maryland (H 565)

House Bill 565 proposes to amend the Maryland Film Production tax credit program by prohibiting the issuance of tax credit certificates for film production activities after June 30, 2023.

Maryland (S 718)

Senate Bill 718 proposes to amend the Maryland Film Production tax credit program as follows:

- Allows the salaries and wages for writers, directors, and producers to qualify as a direct production cost as long as each individual earns less than $500,000; and,

- Increases the annual funding cap to $20 million for fiscal year 2020 (7/1–6/30), and every fiscal year thereafter.

If passed, the Act shall take effect July 1, 2020.

Maryland (H 1284)

House Bill 1284 proposes to amend the Maryland Film Production tax credit program by prohibiting the carry forward of unused funds from one fiscal year to the next.

Rhode Island (H 7501)

House Bill 7501 proposes that the motion picture production fund be used to support the Student Loan Tax Credit Act as of January 1, 2022.

Utah (S 81)

Senate Bill 81 proposes to amend the Utah Motion Picture Incentives program as follows:

- Allows for an additional 5%, not to exceed 25%, to be earned on the dollars left in the state by a production company that engages in postproduction work in Utah;

- Allows the Office of Economic Development to consider giving preference to applicants that engage in postproduction activities in-state; and,

- Eliminates the per project cap under the rebate program, previously $500,000.

Virginia (H 30)

House Bill 30 proposes to appropriate $6.5 million to the Motion Picture Production tax credit program for each of the following fiscal years: 2020 and 2021 (7/1–6/30).

West Virginia (H 4775)

House Bill 4775 proposes to reinstate the West Virginia Film Industry Investment tax credit program for expenses incurred after December 31, 2019. The details of the program are as follows:

- Reinstates a transferable film tax credit equal to 27% of qualified in-state spend and resident and nonresident labor, subject to West Virginia income tax;

- Allows an additional credit equal to 4% on all qualified expenditures when a qualified production hires at least ten West Virginia residents in full-time or apprentice positions, including talent and above-the-line and below-the-line crew, during principal photography;

- Requires a minimum spend of $25,000 in qualified expenditures;

- Reinstates an annual funding cap of $5 million per fiscal year (7/1 – 6/30); and,

- Requires an audit performed by an independent certified public accountant.