THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

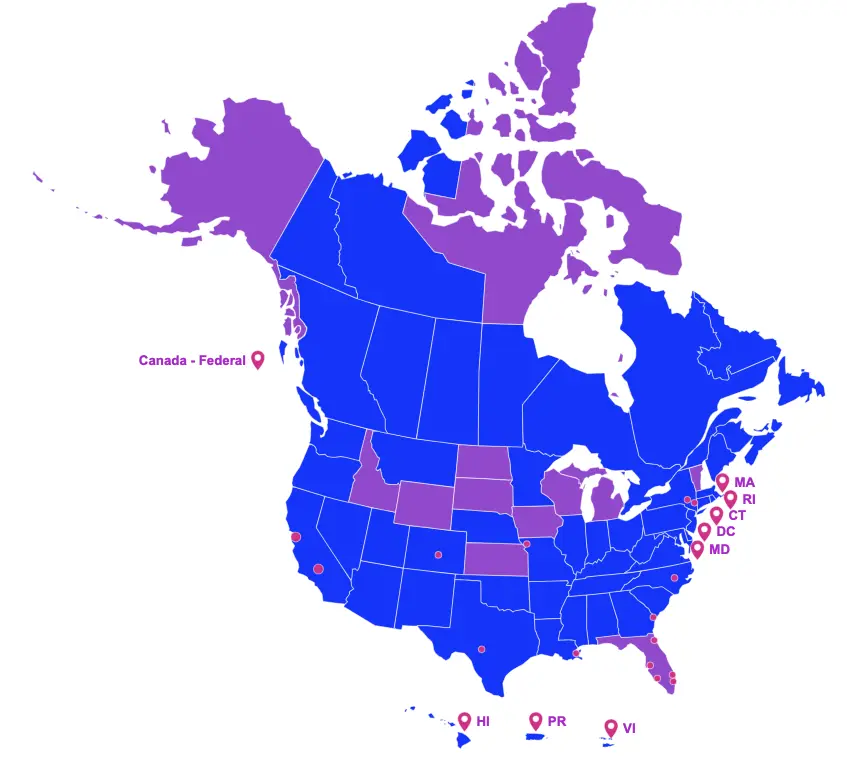

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

New Jersey (A 5580) and (S 3842)

On January 21, 2020, Governor Phil Murphy signed Assembly Bill 5580 and Senate Bill 3842, which amends the New Jersey Film and Digital Media Content Tax Credit program as follows:

- Increases the funding cap to $100 million per fiscal year (7/1–6/30), previously $75 million;

- Allows up to $50 million in unused credits to rollover to the subsequent fiscal year; and,

- Extends the sunset date to June 30, 2028, previously June 30, 2023.

The Act takes effect immediately.

PROPOSED LEGISLATION

Still in the House or Senate

Hawaii (H 2075)

House Bill 2075 proposes to amend the Hawaii Motion Picture, Digital Media and Film production tax credit as follows:

- Increases the annual funding cap to $70 million, previously $50 million.

If enacted, the Act shall take in to effect immediately.

Maryland (H 152) and (S 192)

House Bill 152 and Senate Bill 192 propose to amend the Maryland Film Activity tax credit as follows:

- Reduces the annual funding cap to $10 million, previously $14 million, for fiscal year 2021 (7/1–6/30).

If enacted, the Act shall take effect June 1, 2020.

Oklahoma (H 3920)

House Bill 3920 proposes to amend the Oklahoma Film Enhancement rebate program as follows:

- Increases the annual funding cap to $16 million, previously $8 million, per fiscal year (7/1–6/30).

If enacted, the Act shall take effect July 1, 2020.

Rhode Island (H 7247)

House Bill 7247 proposes to amend the Rhode Island Motion Picture Production tax credit program as follows:

- Allows the film office director to issue a waiver of the primary location requirement for any feature film or television production which spends a minimum of $10 million in qualified expenditures. The primary location requirement is defined as follows:

- At least 51% of the motion picture principal photography days are filmed in-state; or,

- At least 51% of the motion picture’s final production budget is spent and employs at least five individuals during the production in this state; or,

- For documentary productions, at least 51% of the total production days are in-state, including pre-production and post-production locations.

If enacted, the Act shall take effect immediately.

West Virginia (H 4382)

House Bill 4382 proposes to amend the West Virginia Film Industry Investment Act as follows:

- Reinstates the West Virginia transferable film tax credit equal to 27% of qualified in-state spend and resident and nonresident labor, subject to West Virginia income tax;

- Allows an additional credit equal to 4% on all qualified expenditures when a qualified production hires at least ten West Virginia residents in full-time or apprentice positions, including talent and above-the-line and below-the-line crew, during principal photography;

- Requires a minimum spend of $50,000 in qualified expenditures;

- Establishes an annual funding cap of $10 million per fiscal year (7/1 – 6/30), however, the development office may allocate a greater amount of credit for any feature length film produced with “West Virginia” in the title or if the subject of the film is clearly identified as West Virginia; and,

- Requires an audit performed by an independent certified public accountant.