December 4, 2018

Each year, Cast & Crew prepares a summary of key changes in the areas of labor, employment and payroll administration laws. Keeping up with the ever-changing marketplace is crucial to our company when it comes to providing services that our clients rely on. While our “What’s New” does not provide legal advice, it does seek to alert our clients to the myriad issues and challenges that arise in our industry.

State Minimum Wage Increases

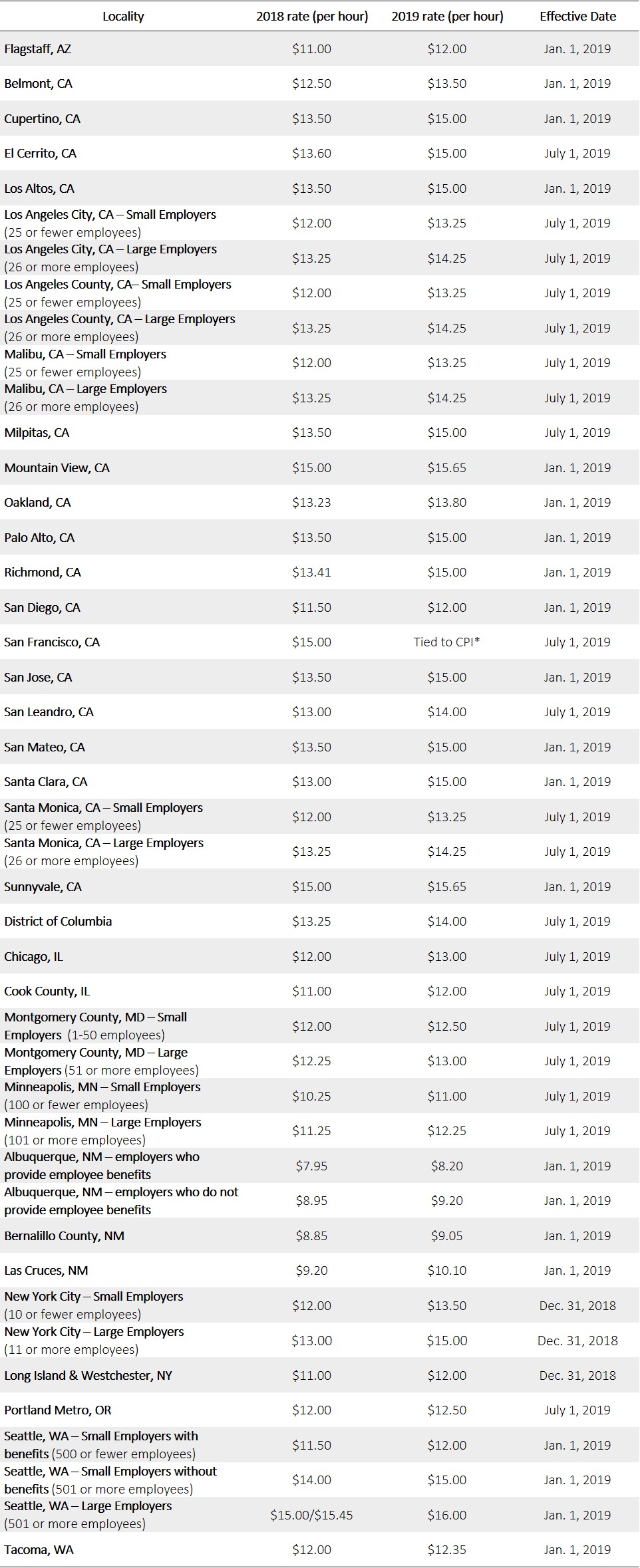

Local Minimum Wage Increases

*CPI is the Consumer Price Index. The CPI is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Sick Leave Laws

Paid Sick Leave in Michigan, Effective April 2019

On Sept. 5, 2018, the Michigan Senate and House of Representatives voted to approve the Michigan Earned Sick Time Act (the “Act”). The Act provides Michigan employees with paid time off to use for the employee’s own mental or physical illness, injury or health condition; the mental or physical illness, injury or health condition of the employee’s family member; to tend to a situation of domestic violence involving the employee or the employee’s family member, or for a public health emergency. Under the Act, employees accrue sick leave at a rate of one hour of sick leave for every 30 hours worked. Accrual and usage caps differ based on employer size. Employers with 10 or more employees must provide 72 hours of paid sick leave per year. Employers with fewer than 10 employees must provide 40 hours of paid sick leave and 32 hours of unpaid sick leave per year. The Act is scheduled to go into effect April 1, 2019 but is likely to see amendments before that date.

Additional information on the law can be found here.

Paid Sick Leave in San Antonio, TX, Effective August 2019

On Aug. 16, 2018 the San Antonio City Council passed the Earned Paid Sick Time Ordinance. The law applies to employees who performs at least 80 hours of work for the same employer in the City of San Antonio. Employees earn sick leave at a rate of one hour of paid sick leave for every 30 hours worked. The yearly cap for paid sick leave is 64 hours for employers with more than 15 employees and 48 hours for employers with 15 or fewer employees. Employees may use paid sick leave when they need to be absent from work because the employee or the employee’s family member suffer illness, injury, stalking, domestic abuse, sexual assault, or otherwise require medical or health care, including preventative care and mental health care. The law is scheduled to go into effect Jan. 1, 2019 for most employers, though changes to the law are expected.

Additional information on the law can be found here.

Paid Sick Leave in Westchester County, NY, Effective March 2019

On Oct. 1, 2018, Westchester County passed the Earned Sick Leave Law, extending sick leave benefits to employees who work more than 80 hours per year in Westchester County. The law allows employees to earn and use up to 40 hours of sick leave a year, accrued at a rate of one hour of sick leave for every 30 hours worked. Sick leave is permitted when an employee needs time off to tend to their own or a family member’s mental or physical illness, injury or health condition, or for certain situations where public health authorities have either determined that an employee or family member’s presence in the community may jeopardize the health of others or have closed the employer’s place of business. The law goes into effect March 30, 2019.

Additional information on the law can be found here.

Family Leave Laws

Paid Family & Medical Leave in Washington, Effective January 2019

Effective Jan 1., 2019, Washington employers and employees will be required to make contributions to the state’s new Paid Family & Medical Leave Program (“PFML”). The 2019 rate is set at 0.4 percent of an employee’s gross wages, subject to the social security cap, shared by employer and employee. Of that 0.4 percent, the employer is responsible for approximately 37 percent and the employee is responsible for the remaining approximately 63 percent, though the employer may elect to pay any part of the employee’s portion. Conditional waiver from the program is permitted in limited situations. Eligible employees are entitled to paid leave under the program beginning Jan. 1, 2020. Permissible reasons for leave are: when an employee welcomes a new child into their family, when an employee needs time off to care for their own or a family member’s serious illness or injury, or for certain military connected events. Details of the program and how it will be administered are still in development.

Resources on how Cast & Crew is helping clients administer PFML are available here, and additional information on the law can be found here.

Updates to New York Paid Family Leave, Effective January 2019

Last January, New York state rolled out the New York Paid Family Leave Program (“NYPFL”). NYPFL provides wage replacement and job protection for employees who take time off work to bond with a new child, care for a family member with a serious health condition, or assist when a family member is deployed abroad on active military duty. NYPFL is funded solely by employee payroll deductions. The 2018 deduction rate was set at 0.126 percent of an employee’s gross wages per pay period, with an annual cap of $85.56. Effective Jan. 1, 2019, the 2019 deduction rate will increase to 0.153 percent of an employee’s gross wages per pay period, with an annual cap of $107.97. Also effective Jan. 1, 2019, the number of weeks eligible employees may take under NYPFL will increase from eight weeks to 10 weeks. Finally, the wage replacement benefit effective Jan. 1, 2019 increases from 50 percent of an employee’s weekly wage (capped at 50 percent of the New York State Average Weekly Wage) to 55 percent of an employee’s weekly wage (capped at 55 percent of the New York State Average Weekly Wage). The maximum weekly benefit for 2019 is $746.41.

Resources on how Cast & Crew is helping clients administer NYPFL are available here, and additional information on the law can be found here

Paid Family & Medical Leave in Massachusetts, Effective July 2019

In the summer of 2018, Massachusetts Governor Charlie Baker signed An Act Relative to Minimum Wage, Paid Family Medical Leave and the Sales Tax Holiday (the “Act”). Described as the “Grand Bargain Bill,” the Act provides Massachusetts workers with up to 12 weeks of paid leave to care for a sick family member or a newborn, and up to 20 weeks of paid medical leave to attend to their own serious medical needs. The Program will be administered by the state and will be co-funded by employer and employee in the form of payroll deductions. The 2019 rate is set at 0.63 percent of employee’s weekly wages. Payroll deductions begin July 1, 2019 and benefits become available to employees beginning Jan. 1, 2021. More information on the Program is forthcoming.

Additional information on the law can be found here.

State & Local Laws

New Electronic Workplace Injury Reporting Requirements in California, Effective December 2018

Certain California employers who are subject to Federal OSHA requirements will soon be required to electronically submit annual injury and illness logs directly to the federal OSHA database. Covered employers will use OSHA’s new online Injury Tracking Application (“ITA”) to submit Form 300A summarizing work-related injuries and illnesses. Covered employers include those with 250 or more employees (with limited exceptions, listed in Section 14300.2 of Title 8 of the California Code of Regulations), and employers with 20-249 employees in specific industries with historically high rates of workplace injuries, not including the entertainment industry. The first online filing deadline is Dec. 31, 2018, with subsequent deadlines in March of each year.

Additional information on the new requirement can be found here and here, and OSHA’s ITA is available here.

#MeToo-Inspired Legislation in California, Effective January 2019

On Sept. 30, 2019, California Governor Jerry Brown signed a number of new bills that seek to combat sexual harassment in the workplace. Among them, Senate Bill 820 prohibits non-disclosure agreements and secret settlement agreements relating to certain claims of sexual misconduct. Assembly Bill 3109 makes unenforceable any provision in a contract or settlement agreement that waives a party’s right to testify in an administrative, legislative or judicial proceeding concerning alleged criminal conduct or sexual harassment. Both laws go into effect Jan. 1, 2019. In addition, Senate Bill 1343 mandates that all employees receive one hour of interactive sexual harassment training and education within six months of hire, and every two years thereafter. The law goes into effect Jan. 1, 2019 and the first round of training must be completed by Jan. 1, 2020.

For a complete list of the new changes and to find more information, click here.

Female Presence on Boards of Directors Now Required in California, Effective 2019

On Sept. 30, California Governor Jerry Brown signed into law Senate Bill 826 which requires publicly traded companies in California to have at least one woman on their board of directors by the end of the 2019 calendar year. By the end of the 2021 calendar year, the number increases to a minimum of two women if the corporation has five directors, or to three directors if the corporation has six or more directors. The law applies to public companies whose principal offices are located in California according to the corporations SEC 10-K forms. The law is the first of its kind in the nation.

Additional information on the law can be found here.

Mandatory Employee Reimbursement, Effective January 2019

Amendments to The Illinois Wage Payment and Collection Act will require Illinois employers to reimburse employees for “all necessary expenditures or losses incurred by the employee within the employee’s scope of employment and directly related to services performed for the employer.” These may include expenses or losses that employees incur while performing tasks that benefit the employer or are otherwise required by the employer – potentially including employee phone payments and travel expenses. Employers may establish written guidelines that define “necessary expenditures” and that set the general parameters for the reimbursement policy. The law goes into effect Jan. 1, 2019.

Additional information on the program can be found here.

Expansions to Equal Pay Law in Oregon, Effective January 2019

Recent amendments to Oregon’s Equal Pay Act (“EPA”) make it unlawful for employers to make discriminatory compensation decisions on the basis of an employee’s status as a member of any protected class – including race, color, religion, sex, sexual orientation, national origin, marital status, veteran status, disability or age. Historically, the law was limited only to protect against discriminatory compensation decisions on the basis of gender. Discriminatory practices under the law include discrepancies in the payment of wages or other compensation for work of comparable character, screening job applicants based on current or past compensation, or determining compensation for a position based on current or past compensation of a prospective employee. The amendments to the law go into effect Jan. 1, 2019.

Additional information on the law can be found here.

Expansions to Anti-Sexual Harassment Training Requirements New York City, Effective April 2019

On May 9, 2018, Mayor Bill de Blasio signed into law the Stop Sexual Harassment in NYC Act. The law is package of several bills aimed at preventing sexual harassment in the workplace. One component of the package is a more robust anti-sexual harassment training requirement for New York City employers. New York City employers with more than 15 employees will be required to conduct annual anti-sexual harassment training for all employees. The NYC Commission on Human Rights is expected to develop and publish a model training for employers that meets all of the discrete requirements of the law. The law goes into effect April 1, 2019.

Additional information on the law can be found here.

State-Sponsored Retirement Program in Illinois, Effective 2018-2019

Illinois Secure Choice is a new state-sponsored retirement savings program for workers in Illinois who do not have access to an employer-sponsored retirement plan. Employers in Illinois with 25 or more employees who have been operating in the state for at least two years and do not already offer a retirement plan to their employees are required to participate in the program. The Illinois State Treasurer’s office is administering the program and is contacting employers directly with registration details and requirements. While employers are required to offer the program, they are not required to contribute on behalf of employees. Participating employees may choose their contribution rate (or opt-out entirely), though the default rate is five percent of gross wages. Employer registration began in November 2018 and continues through November 2019.

Additional information on the Program can be found here.

Federal Changes

Social Security Wage Base Increase, Effective January 2019

Each year, the Social Security Administration limits the amount of earnings subject to taxation for a given year. This limit changes annually to match the national average wage index. In October 2018, the Social Security Administration announced the annual limit for the 2019 year will be $132,900. This is an increase from the $128,400 limit in 2018.

Additional information be found here.

Important Court Cases

Kentucky Becomes First State to Prohibit Mandatory Arbitration as a Condition of Employment

Kentucky is the first state in the U.S. to disallow employers from requiring prospective employees to sign a mandatory arbitration agreement as a condition of employment. The decision came out of the Kentucky Supreme Court in Northern Kentucky Area Development Dist. v. Snyder on Oct. 2, 2018. The Court noted that the purpose of the decision was not to attack arbitration agreements in general, but rather to dissuade employers from making hiring decisions based on whether or not an employee would sign an agreement. Effective as of Oct. 2, 2018, employment offer letters or agreements in Kentucky that contain mandatory arbitration provisions are void as a matter of law.

Additional information on the ruling can be found here.

Labor Relations Leadership Update

Retirement of Shirley White

Shirley White, who many of you have worked with and gotten to know over the years as our Vice President, Labor Relations, will retire from Cast & Crew in January 2019 after 34 years with the company. Shirley, who is widely recognized across the industry for her Labor Relations expertise, has spent her entire career at Cast & Crew, specializing in production accounting, payroll operations, client support, pension, health and welfare regulations and labor relations. She is also the only non-studio person to be appointed to the board of Contract Services Administration Trust Fund and Contract Services Administration Training Trust Fund (CSATF and CSATTF), of which she served as Chairman of the Board for three years.

Shirley has long guided our Labor Relations capability with distinction and character and all of us at Cast & Crew are grateful for what she has meant to this company. She has been both a great mentor and example to her colleagues and a true partner to our clients. We will miss her contributions – and personality.

Promotion of Juli Totta

At the same time, we’re pleased to announce that Juli Totta will be assuming the Vice President, Labor Relations role and heading up the Labor Relations group that supports both Cast & Crew and CAPS. Juli has more than 30 years of experience in Labor Relations/Payroll and will continue to build and expand on the labor expertise the department provides to our clients.

We are extremely fortunate to have someone like Juli ready to step up and take over for Shirley. With her broad and deep understanding of entertainment Labor Relations, we know Juli will be a great asset to Cast & Crew as we continue to move through an exciting time in our company’s evolution.

Cast & Crew’s Labor Relations team remains committed to meeting your needs. Our group comprises 12 dedicated staff, with more than 145 years of combined labor relations payroll experience, who provide guidance on industry practices, collective-bargaining agreement interpretation, contract administration, union relations and audit assistance.

Please contact our Labor Relations department at info_labor@castandcrew.com should you have any questions regarding this matter.

—

For further information, please contact Compliance@castandcrew.com.

The proceeding information is provided for informational purposes only, should not be construed as or relied upon as legal advice and is subject to change without notice. If you have questions concerning particular situations, specific payroll administration or labor relations issues, please contact your counsel.